Imagine living in a place where you get to keep everything you earn—no income tax, no capital gains tax, just pure financial freedom. Tax free countries offer this enticing possibility, attracting entrepreneurs, retirees, and digital nomads alike. These nations have designed their tax systems to encourage investment, boost tourism, or simply provide a haven for those seeking a lighter financial burden.

Whether you’re looking to grow your wealth, start a business, or enjoy a laid-back lifestyle, these destinations can make your money go further. From tropical islands to bustling urban hubs, tax free countries come in all shapes and sizes, each with its unique benefits and opportunities.

But relocating to a tax haven isn’t just about saving money. It’s about understanding the trade-offs, legal implications, and lifestyle changes that come with it. So, are you ready to explore where you could live tax-free? Let’s dive in.

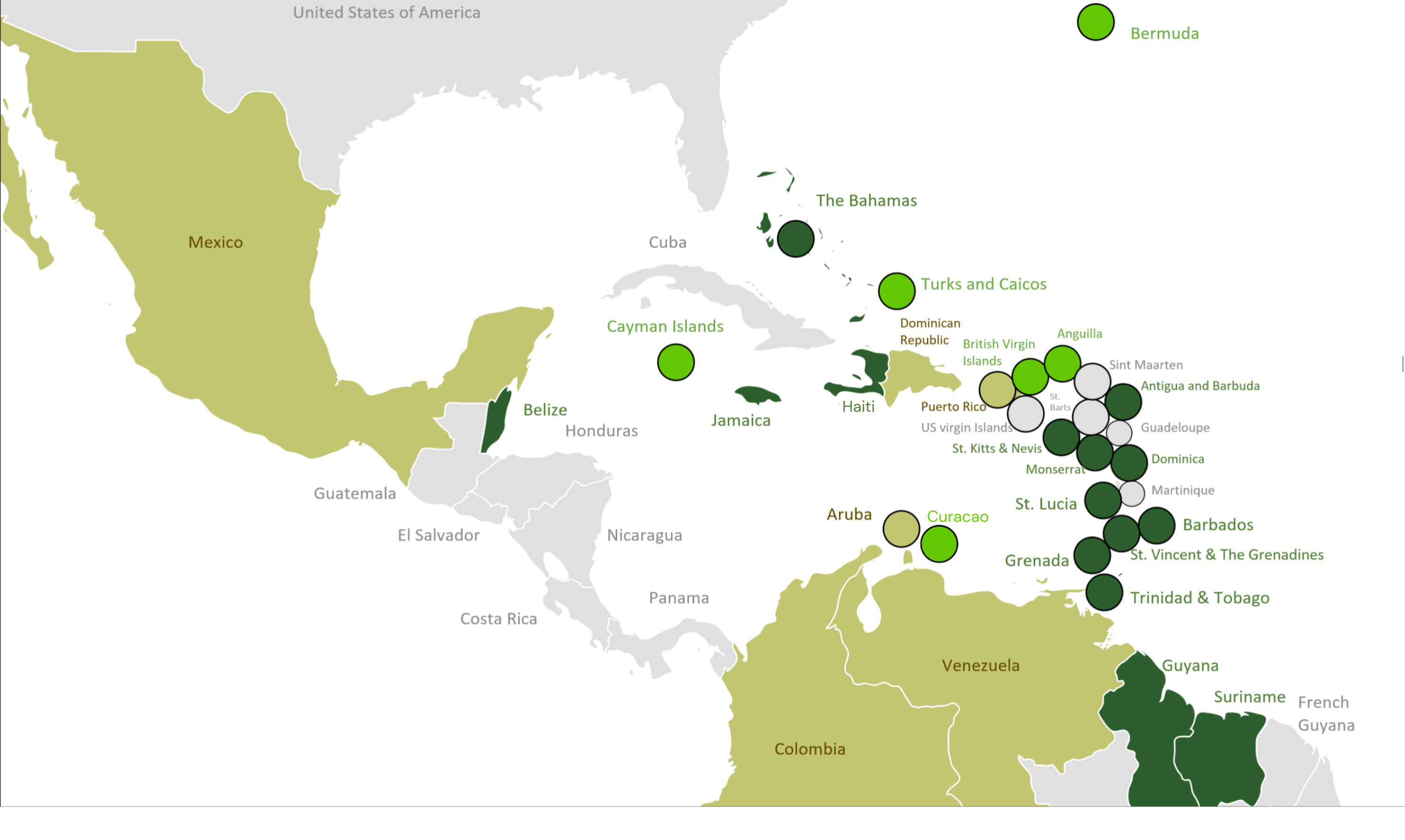

Tax-Free Countries: Living and Investing in the Caribbean

Living tax-free in the Caribbean offers opportunities for financial freedom and a desirable lifestyle. The region attracts individuals seeking minimal tax burdens combined with tropical living.

Introduction to Tax-Free Living in the Caribbean

The Caribbean features attractive tax havens, where income tax, capital gains tax, and wealth tax are often absent. Many of these nations provide legal frameworks to support offshore tax planning and favorable tax residency conditions. Whether you’re a business owner or retiree, these destinations provide diverse options for maintaining tax efficiency and enjoying an island lifestyle.

Why Choose the Caribbean for Tax-Free Living?

The Caribbean’s tax-friendly policies make it ideal for individuals aiming to optimize their tax exposure. Countries in this region offer no direct taxes on worldwide income, including dividends and capital gains, which is beneficial for high-net-worth individuals. Its accessibility and residency programs simplify relocation, reducing barriers for those seeking to establish tax residency in the Caribbean. Several nations also promote foreign investment through citizenship by investment (CBI) programs, enabling fast-track access to their financial benefits and residency.

Overview of Tax Havens in the Region

The best tax havens in the Caribbean include nations like the Bahamas, the Cayman Islands, and Saint Kitts and Nevis. The Bahamas eliminates income, inheritance, and capital gains taxes, positioning itself as a key destination for living tax-free in the Caribbean. The Cayman Islands provides a strong financial infrastructure and tax-neutral environment tailored for businesses and private individuals engaging in offshore tax planning. Saint Kitts and Nevis highlights its CBI program, which grants tax residency without imposing direct income taxes. Each jurisdiction prioritizes a combination of tax efficiency and lifestyle appeal, catering to investors and expatriates.

Key Benefits of Tax-Free Living and Investing

Financial Freedom

Tax-free living helps you retain your entire income without deductions for income tax or capital gains tax. In locations like the Caribbean, which attract investors, entrepreneurs, and retirees, this freedom enhances savings and wealth accumulation. You can direct these funds toward personal goals, investments, or expanding your business portfolio.

Wealth Growth Opportunities

Countries with no taxes on income or investment gains, such as the Cayman Islands or Saint Kitts and Nevis, provide ideal conditions for preserving and growing wealth. Without tax-related liabilities, offshore tax planning becomes more efficient, allowing you to prioritize high-return investment opportunities. Many tax-free jurisdictions also streamline corporate tax structures, which is advantageous for businesses.

Simplified Taxation Systems

Relocating to tax havens like the Bahamas ensures you deal with fewer tax-related complexities. Many of these nations operate without burdensome tax filings or audits, saving you time and resources. If you’re pursuing tax residency in the Caribbean, it’s easier to manage finances compared to high-tax regions.

Increased Global Mobility

Tax havens offering citizenship or residency by investment programs, such as Saint Kitts and Nevis, grant access to visa-free or visa-on-arrival travel across multiple countries. By leveraging these opportunities, you’re not only reducing taxes but also gaining enhanced global mobility, which benefits business and personal travel.

Attractive Investment Climate

Living tax-free in the Caribbean supports diverse investment options. Real estate, for instance, remains a favored choice among those capitalizing on minimal or no property tax in these jurisdictions. These regions also draw foreign investors due to stable political conditions and lenient business regulations.

Higher Disposable Income

Eliminating income or capital gains taxes directly increases your purchasing and investment power. Whether you’re a digital nomad or seeking offshore tax planning solutions, tax-free nations allow you to capitalize on your earnings without reductions, empowering a better quality of life.

Top Tax-Free Countries in the Caribbean

Living tax-free in the Caribbean offers an unmatched combination of financial benefits and idyllic lifestyles. Here are some of the best tax havens in the region to consider for offshore tax planning and tax residency opportunities.

The Bahamas: Luxury and Tax Efficiency

The Bahamas is a premier choice for tax-free living in the Caribbean. It imposes no income, capital gains, inheritance, or corporate taxes, making it highly attractive to high-net-worth individuals.

You can obtain permanent residency through property investment, with a minimum threshold of $750,000. The Bahamas offers an advanced infrastructure for business and a robust financial services sector, ensuring a streamlined offshore tax planning experience. Its pristine beaches and luxury real estate options further enhance its appeal as a desirable tax haven for relocation.

Cayman Islands: The Gold Standard in Offshore

The Cayman Islands stands out as the gold standard among tax-free countries. It has no income, capital gains, withholding, or corporate taxes, ideal for professionals and businesses seeking tax efficiency.

Permanent residency is available through substantial investment, typically in real estate exceeding $1.2 million. The country’s status as a global financial hub ensures access to top-tier banking and wealth management services, vital for leveraging tax advantages. With world-class amenities and a stable political environment, the Cayman Islands ranks among the best tax havens for individuals and corporations.

St. Kitts and Nevis: Citizenship and Asset Protection

St. Kitts and Nevis offers benefits through its Citizenship by Investment (CBI) program. This allows you to gain citizenship by donating $125,000 to the Sustainable Growth Fund or investing in real estate starting at $200,000.

There are no personal income, estate, or gift taxes, making it favorable for asset protection. Gaining citizenship here includes visa-free travel to over 150 countries, providing unmatched global mobility. St. Kitts and Nevis represents a compelling tax residency option if you’re seeking financial security along with a second passport.

Panama: The Center of Latin America

While technically part of Central America, Panama often features in discussions on Caribbean tax havens due to its strategic location. It charges no tax on foreign-earned income, retaining your offshore earnings entirely tax-free.

By enrolling in the Friendly Nations Visa program with a local investment, you can gain permanent residency. Panama is known for its territorial tax system, a stable economy, and robust banking framework, which together provide a solid platform for offshore tax planning. Additionally, the vibrant metro areas and close proximity to the US make Panama a practical choice for individuals and businesses.

Offshore Tax Planning Strategies

Effective offshore tax planning helps you maximize financial benefits when considering relocation to tax-free countries or regions like the Caribbean. Strategic approaches such as forming companies, utilizing treaties, and securing tax residency provide long-term financial advantages.

Establishing Offshore Companies and Trusts

Offshore companies and trusts play a key role in managing income and securing tax advantages. Establishing an offshore company allows you to conduct global business operations while taking advantage of jurisdictions with zero income or corporate taxes. For example, the Cayman Islands offers robust asset protection and no direct taxes on corporate profits, making it a popular choice for entrepreneurs.

Trusts, on the other hand, help safeguard wealth and reduce inheritance tax exposure. By setting up an offshore trust in tax-friendly regions such as Nevis, you protect your assets from creditors and minimize tax liabilities. These structures also ensure confidentiality, which is often a priority in tax-free jurisdictions. Combining these tools streamlines asset management while leveraging the financial systems of the best tax havens.

Leveraging Double Taxation Treaties

Double taxation treaties prevent individuals or companies from being taxed in both their country of residence and the jurisdiction of earned income. If you maintain connections to a country with such agreements, you can ensure that your income or investments from a tax-free haven like Panama aren’t subject to dual taxation. This reduces your overall tax burden and simplifies compliance.

For instance, Panama’s tax system excludes foreign-earned income, making it an effective jurisdiction to pair with treaties for global investors. Utilizing these treaties allows you to retain more wealth and avoid complex issues arising from conflicting tax obligations. When designing your offshore tax strategy, consider jurisdictions with favorable treaty networks to optimize benefits.

Protecting Assets Through Tax Residency Programs

Tax residency programs provide pathways to achieve lower or zero-tax obligations while protecting your wealth. In the Caribbean, the Bahamas and Saint Kitts and Nevis offer straightforward tax residency options with minimal bureaucracy. The Bahamas grants residency with no income, capital gains, or inheritance taxes, making it attractive for those pursuing tax-free living in the Caribbean.

Saint Kitts and Nevis’s Citizenship by Investment program also combines tax benefits with global mobility. By investing in qualifying real estate or government funds, you unlock citizenship and residency opportunities while safeguarding your financial assets. These programs connect you to the best tax havens and enable tailored asset protection strategies.

Residency Options in Tax-Free Countries

Relocating to tax-free countries offers numerous financial and lifestyle advantages. Structured pathways, such as residency programs and citizenship by investment, make the transition seamless for individuals seeking to benefit from living tax-free in the Caribbean.

How to Obtain Residency in Tax Havens

Residency programs in tax havens facilitate your relocation while ensuring compliance with local laws. Tax residency in the Caribbean is often tied to investment, physical presence, or employment opportunities.

- Bahamas Permanent Residency: You secure permanent residency by purchasing real estate worth at least $750,000. Fast-track options are available for investments exceeding $1.5 million.

- Saint Kitts and Nevis Residency: Their fast-track residency program is linked to the Citizenship by Investment initiative, requiring a minimum contribution of $125,000 to the Sustainable Growth Fund or investment in pre-approved real estate.

- Cayman Islands Residency: By investing $2.4 million or more in real estate, you can qualify for certificates of permanent residency.

Governments enforce minimal residence requirements, making these countries highly attractive for individuals engaged in offshore tax planning.

Citizenship by Investment Opportunities

Caribbean nations are globally recognized for their citizenship by investment programs, offering tax benefits and visa-free mobility. These programs align with a tax residency strategy while enhancing your global access.

- Antigua and Barbuda: Invest $100,000 in the National Development Fund or at least $200,000 in approved real estate projects. Gain visa-free travel to over 150 destinations while enjoying tax exemptions on wealth, inheritance, and income.

- Dominica: A $100,000 donation to the Economic Diversification Fund or a $200,000 real estate investment qualifies you for citizenship. The program enables access to an appealing tax regime and dual citizenship benefits.

- Saint Kitts and Nevis: As the oldest program, it offers global mobility perks while exempting you from income, capital gains, and inheritance taxes with investments starting at $125,000.

These options streamline your transition for those seeking the best tax havens while offering full tax-free living benefits.

Long-Term Benefits of Caribbean Residency

Holding tax residency in the Caribbean offers enduring advantages. Minimal tax burdens let you retain wealth while opening pathways for financial freedom and global mobility.

- Tax-Free Earnings: You can enjoy complete tax exemptions on income, capital gains, and inheritance in countries like the Bahamas or Saint Kitts and Nevis, supporting long-term wealth accumulation.

- Investment Growth: Caribbean tax havens provide unparalleled opportunities in real estate markets and offshore tax planning, where high returns bolster your savings.

- Enhanced Mobility: Residency programs in best tax havens offer visa-free or visa-on-arrival access to hundreds of global destinations, increasing your travel freedom for business or leisure.

Long-term residency ensures lower living costs and a premium lifestyle, leveraging both financial and strategic advantages of living tax-free in the Caribbean.

Conclusion

Choosing a tax-free country can transform your financial future, offering unparalleled opportunities for wealth preservation and growth. The Caribbean stands out as a prime destination, blending financial advantages with a vibrant lifestyle that’s hard to resist.

By understanding the residency options, investment opportunities, and legal frameworks, you can strategically position yourself to enjoy the benefits of tax-free living. Whether you’re seeking financial freedom, global mobility, or a fresh start in a tropical paradise, the right tax haven could be your gateway to a more prosperous and fulfilling life.