When it comes to managing your finances, understanding the difference between private banking and wealth management is crucial. Both services cater to high-net-worth individuals, but they offer distinct approaches to handling your financial needs and goals. Choosing the right option can significantly impact how your wealth is preserved and grown.

Private banking focuses on providing personalized banking services, often through a dedicated relationship manager. It’s about convenience, exclusive perks, and tailored solutions for your financial activities. Wealth management, on the other hand, takes a broader approach, combining investment advice, estate planning, and long-term financial strategies to secure your future.

Deciding between private banking and wealth management depends on what you value most in financial services. Whether it’s seamless banking or comprehensive financial planning, knowing the strengths of each can help you make informed decisions to optimize your wealth.

Private Banking vs. Wealth Management: Key Differences Explained

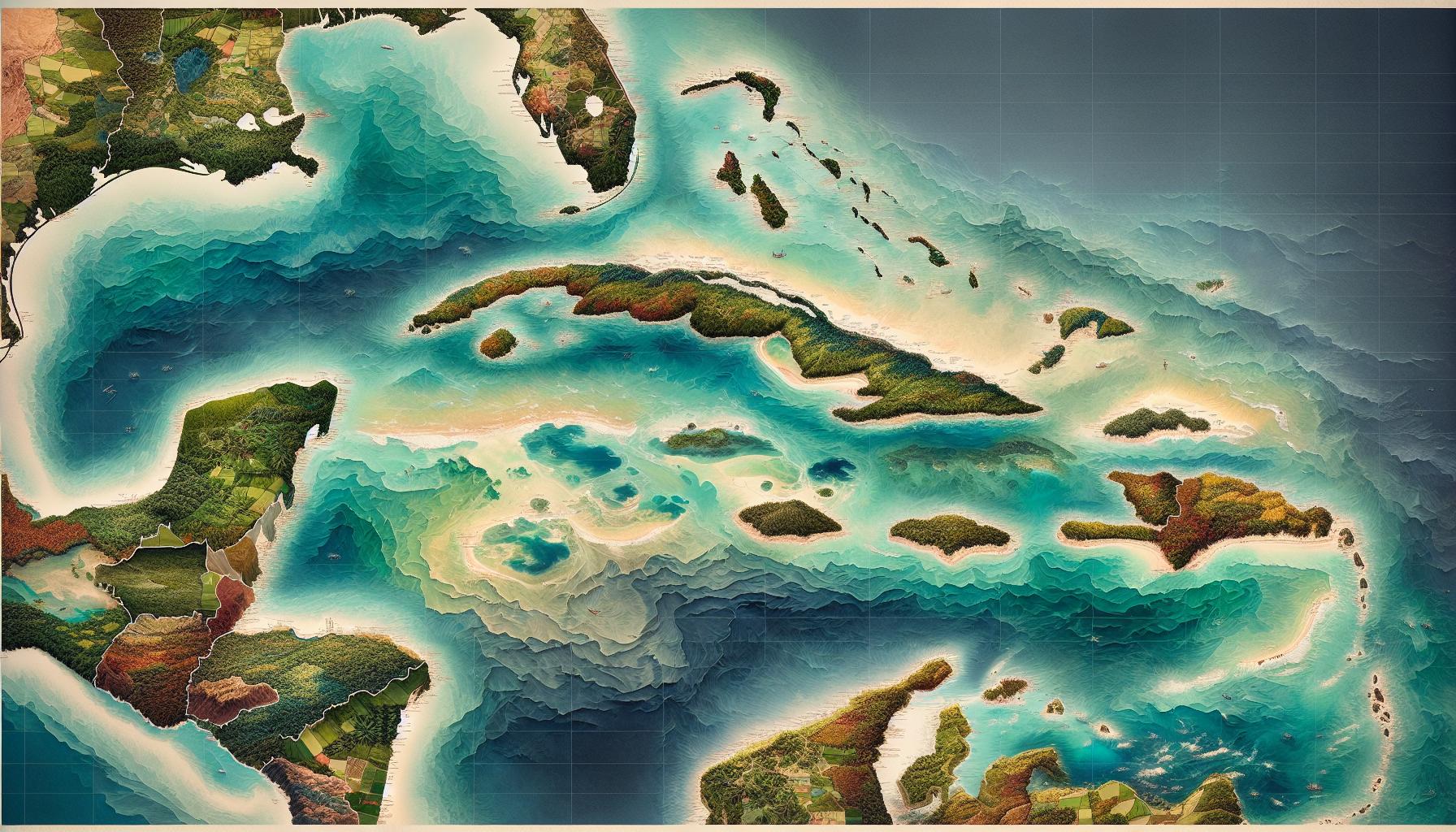

Private banking and wealth management in the Caribbean cater to high-net-worth individuals (HNWIs), offering distinct yet complementary services. Understanding their specific features and benefits helps align your financial objectives with the right service.

Introduction to Financial Services in the Caribbean

The Caribbean has become a preferred destination for private banking and wealth management, thanks to its favourable tax regimes, political stability, and reputation for discretion. Prominent locations like the Cayman Islands and the Bahamas offer world-class financial infrastructure, attracting HNWIs globally.

Overview of Private Banking and Wealth Management

Private banking focuses on delivering personalized banking services, managing your day-to-day financial needs with tailored products. It typically includes current accounts, savings, loans, and credit facilities. In jurisdictions like the Cayman Islands, private banking is known for its confidentiality and client-centric approach.

Wealth management takes a broader role in financial planning, integrating services like investment advice, estate planning, and tax optimization. It combines wealth and investment management strategies to provide long-term solutions for growing and preserving your wealth. Leading firms in the Caribbean, such as those in Bermuda and the British Virgin Islands, specialize in private wealth management with multi-jurisdictional expertise.

Why These Services are Essential for High-Net-Worth Individuals

Private banking ensures your convenience in managing complex financial activities, freeing up time for other pursuits. For example, elite institutions in the Bahamas offer bespoke financial services with unmatched flexibility.

Wealth management is critical for diversifying income and securing generational wealth. Investment opportunities in the Caribbean, such as trust funds in Barbados, are globally recognised for protecting assets while enhancing growth potential. When combined, both services help mitigate risks while addressing multi-faceted financial goals.

- Cayman Islands: Renowned for private banking and trust services.

- Bahamas: Known for tailored wealth management solutions and tax neutrality.

- Bermuda: A hub for sophisticated wealth and investment management services.

- British Virgin Islands: Recognised for strong legal frameworks supporting wealth growth.

- Barbados: Prominent in estate planning and asset protection initiatives.

Understanding Private Banking

Private banking provides personalised financial services to manage your high-value banking needs. Unlike broad wealth and investment management, it focuses more on tailored, day-to-day banking solutions for high-net-worth individuals (HNWIs).

Services Offered by Private Banks

- Personalized Banking Accounts: Private banks offer customized savings, current, and multi-currency accounts to simplify global transactions.

- Lending Solutions: Access tailored loan programmes such as mortgages, lines of credit, or specialised lending for unique needs like luxury purchases.

- Investment Advice: Some private banks extend basic guidance on low-risk investment options as part of their services.

- Discretionary Services: Enjoy perks like dedicated relationship managers and exclusive banking benefits designed for your convenience.

Benefits of Private Banking

- Exclusive Access: Private banking ensures you receive priority services, bypassing standard banking queues or processes.

- Customization: Financial products and services are shaped to fit your specific goals, providing flexibility and efficiency.

- Confidentiality: High-level discretion safeguards your privacy, a vital factor for HNWIs managing significant assets.

- Convenience: Managing complex financial transactions becomes seamless, saving you time and effort.

- Cayman Islands: Renowned for multi-currency accounts, lending services, and trust management offered through well-regulated private banks.

- Bahamas: Known for its robust private wealth management institutions, offering bespoke banking services alongside strong confidentiality measures.

- British Virgin Islands: A rising hub for customized financial solutions, enhancing the appeal of exclusive private banking services.

- Barbados: Offers private and specialized account options alongside favourable investment conditions for HNWIS.

These islands combine regulatory efficiency and client-centric offerings, making the Caribbean an attractive destination for private banking.

Understanding Wealth Management

Wealth management combines financial planning, investment strategies, and advisory services to grow and safeguard assets over the long term. It’s tailored to suit the unique requirements of HNWIs focusing on wealth preservation, growth, and legacy planning.

What Wealth Management Encompasses

Wealth management involves a comprehensive approach to financial services. Core components include investment management, estate planning, tax optimization, retirement strategies, and risk assessment. The focus extends beyond immediate financial needs, covering generational wealth transfer and philanthropic endeavours.

Specialized advisors analyze your financial goals and develop strategies aligned with these objectives. Services might include diversifying portfolios through equities, bonds, and alternative investments or structuring trusts to ensure tax efficiency. Comparatively, private wealth management often offers boutique solutions prioritizing personalized advice, whereas wealth management integrates broader financial disciplines.

Benefits of Wealth Management Services

Wealth management services provide tailored strategies to achieve financial objectives while mitigating risks. By combining aspects of wealth and investment management, these services improve portfolio performance and adapt to market conditions.

Key benefits include:

- Customized Investment Plans: Advisors determine suitable asset allocation based on risk tolerance, ensuring a balance between growth and security.

- Holistic Wealth Strategies: Comprehensive solutions integrate legal, estate, and tax planning into financial strategies.

- Legacy Planning: Facilitates intergenerational wealth transfer, ensuring assets transition smoothly to heirs.

- Global Expertise: Wealth management bank professionals with cross-border financial knowledge address international investment complexities.

Popular Caribbean Islands for Wealth Management

Caribbean nations are favoured destinations for wealth management due to their regulatory frameworks and beneficial tax policies. Some of the most prominent options include:

- Cayman Islands: Offers multi-currency accounts, fund management expertise, and robust trust services.

- Bahamas: Renowned for its wealth and investment management services, it focuses on bespoke financial structures with privacy guarantees.

- British Virgin Islands: Emerging as a hub for tailored investment solutions and tax-friendly structures.

- Barbados: Provides flexible options with treaty advantages, beneficial for HNWIs looking for global asset diversification.

Wealth management in the Caribbean balances strategic investment opportunities with the legal and tax advantages required for long-term financial security.

Key Differences Between Private Banking and Wealth Management

Understanding the differences between private banking and wealth management is essential when deciding the right approach for achieving your financial objectives in the Caribbean. Both services target high-net-worth individuals (HNWIs) but differ significantly in focus, offerings, and accessibility.

Service Offerings and Client Focus

Private banking delivers tailored banking solutions focused on managing your day-to-day financial needs. Key services include multi-currency accounts, lending facilities, and exclusive benefits. Private banking in the Caribbean often emphasizes discretion and personalized financial support, with renowned locations such as the Cayman Islands and the Bahamas offering bespoke banking services.

Wealth management provides a comprehensive approach encompassing financial planning, investment strategies, and estate planning. Its primary focus lies in wealth preservation and growth strategies, integrating tax optimization and legacy planning. Caribbean jurisdictions like the British Virgin Islands and Barbados are ideal for private wealth management and wealth and investment management, attracting HNWIs with their regulatory advantages.

Customization vs. Standardized Solutions

Customization remains a hallmark of wealth management. Professionals design bespoke strategies aligning with your financial goals, investment preferences, and multi-generational wealth transfer plans. Tailored investment strategies in Caribbean hubs like Barbados account for individual market conditions, ensuring long-term performance.

Private banking offers more standardized solutions, though with certain exclusive elements like customized lending or account terms. Locations such as Bermuda provide tailored everyday banking with added advantages like confidentiality. These services are less complex but prioritize convenience and exclusivity.

Cost Structures and Accessibility

Private banking often requires lower entry thresholds compared to wealth management, making it accessible to a broader range of HNWIS. Costs here generally include banking fees or interest rates, with Caribbean banks offering competitive structures in locations like the Bahamas and Cayman Islands.

Wealth management entails higher costs due to its holistic services. Fees typically include asset management percentages or customized advisory costs. The Cayman Islands, a leader in wealth management, offers premium services positioned for significant asset holders prioritizing extensive strategic guidance.

Choosing the Right Option for Your Financial Goals

Whether private banking or wealth management aligns with your financial goals depends on various factors, such as your current needs, future planning, and investment aspirations. Optimizing the use of these services can significantly impact wealth preservation and growth.

Factors to Consider When Deciding

Evaluate the scope of services. Private banking focuses on personalized financial services such as account management, credit solutions, and basic advisory support. These services are ideal if you value confidentiality and streamlined support for day-to-day banking needs. If you’re searching for comprehensive financial planning, including investment strategies, estate management, and tax optimization, wealth management provides wider solutions.

Consider entry thresholds. Private banking often requires lower balances to access its services compared to private wealth management, which involves higher costs due to the holistic and customized nature of the services.

Prioritize your financial goals. Private banking offers effective resources for short-term requirements like managing multi-currency accounts and exclusive loan facilities. In contrast, wealth and investment management focus on long-term wealth preservation and legacy planning, making them suitable for intergenerational financial strategies.

Account for geographic preferences. Caribbean destinations like the Cayman Islands and the Bahamas stand out for private banking due to enhanced discretion and bespoke account services. Meanwhile, Barbados and the British Virgin Islands excel in wealth management offerings with favourable conditions for estate planning, tax efficiency, and investment growth.

How to Leverage Both Services for Comprehensive Financial Planning

Integrate services strategically. Combining the efficiencies of private banking for immediate financial needs with the depth of private wealth management allows seamless control over both liquidity and wealth accumulation.

Use private banking for convenience. Multi-currency accounts in locations like the Cayman Islands or bespoke credit facilities offered in the Bahamas enable effective handling of day-to-day financial priorities.

Apply wealth management for long-term strategies. Services such as estate planning and tax optimization are particularly advantageous in regulatory-friendly jurisdictions like Barbados and the British Virgin Islands.

Tailor approaches to regional expertise. For instance, wealth management banks in the Cayman Islands specialize in trust structures, while private banking institutions in the Bahamas offer enhanced confidentiality for high-value accounts.

Focus on complementarity. Accessing both services can amplify financial outcomes if paired with clearly defined goals, leveraging private banking’s operational efficiency alongside wealth management’s detailed planning.

Keep these considerations and strategies in mind when selecting the optimal service, particularly in prominent Caribbean hubs recognised for their financial expertise.

Conclusion

Choosing between private banking and wealth management depends on your financial priorities, goals, and the level of service you require. Both options offer unique advantages, and understanding their differences allows you to make more informed decisions about your wealth.

By leveraging the expertise of professionals in renowned financial hubs like the Caribbean, you can access tailored solutions that align with your needs. Whether you prioritize day-to-day convenience or long-term wealth growth, a strategic approach combining both services can help you achieve optimal financial outcomes.

Frequently Asked Questions

What is the main difference between private banking and wealth management?

Private banking focuses on personalized financial services for day-to-day needs, such as savings, loans, and credit. Wealth management, on the other hand, offers a comprehensive approach, encompassing investment strategies, estate planning, and long-term wealth preservation and growth.

Who are private banking and wealth management services designed for?

Both services cater to high-net-worth individuals (HNWIs). Private banking is ideal for those seeking tailored solutions for everyday financial needs, while wealth management is suited for individuals requiring expert wealth preservation and growth strategies.

Why is the Caribbean a popular destination for these services?

The Caribbean is favoured for its favourable tax regimes, political stability, and strong reputation for confidentiality. Locations like the Cayman Islands and Bahamas are renowned for their expertise in private banking and wealth management.

What services does private banking typically offer?

Private banking provides customized account options, tailored lending solutions, basic investment advice, and discretionary services to streamline clients’ day-to-day banking needs.

What are the primary components of wealth management?

Wealth management includes financial planning, investment strategies, tax optimization, estate planning, retirement planning, and risk assessment with a strong focus on wealth preservation and growth.

How do entry thresholds differ between private banking and wealth management?

Private banking often has lower entry requirements, offering convenience and discretion. Wealth management typically requires higher entry thresholds due to its holistic and long-term focus.

Can I use both private banking and wealth management services simultaneously?

Yes, combining private banking for short-term financial needs with wealth management for long-term strategies can create a comprehensive financial plan tailored to individual goals.

What is unique about private banking in the Cayman Islands?

The Cayman Islands is known for offering multi-currency accounts and sophisticated trust management services, making it a key destination for private banking.

What makes wealth management in Barbados attractive?

Barbados provides favourable investment conditions, specialized account options, and strong regulatory frameworks, making it an appealing location for wealth management services.

How do I decide between private banking and wealth management?

Evaluate your financial goals, needs, and priorities. Private banking is best for managing day-to-day finances, while wealth management focuses on preserving and growing wealth over the long term.