The CARICOM Caribbean Community is more than just a regional organization; it’s a powerful force uniting 15 member states across the Caribbean. Whether you’re exploring its role in fostering economic integration or its commitment to addressing shared challenges, CARICOM plays a vital part in shaping the region’s future. It’s a hub for collaboration that strengthens ties between its diverse nations.

You’ll find CARICOM at the heart of initiatives promoting trade, sustainable development, and cultural exchange. From tackling climate change to enhancing regional security, this community works tirelessly to improve the lives of its citizens. It’s a testament to what can be achieved when countries come together with a shared vision.

Understanding CARICOM’s impact isn’t just about politics or economics—it’s about how it touches everyday life. Its efforts drive progress in education, healthcare, and tourism, ensuring a brighter future for the Caribbean and its people.

CARICOM Countries: A Closer Look at Regional Collaboration

The Caribbean Community (CARICOM) demonstrates the strength of regional collaboration through shared efforts in trade, education, health, and sustainable development. By addressing collective challenges, CARICOM countries work toward creating a unified and resilient Caribbean.

Introduction to CARICOM and Its Objectives

CARICOM is a regional initiative fostering economic integration and cooperation among its 15 member states, including Barbados, Jamaica, and Trinidad and Tobago. Established in 1973 through the Treaty of Chaguaramas, CARICOM promotes the collective development of the region’s people while respecting each nation’s sovereignty. Coordination among these CARICOM members strengthens their global presence and addresses mutual concerns like climate change and economic disparity.

The organization’s objectives include enhancing free trade, improving living standards, and fostering cultural exchange between nations. CARICOM organizations facilitate this collaboration by creating policies and programs that address critical areas such as public health, renewable energy, and education reform. Through mutual cooperation, CARICOM countries leverage their shared resources to achieve long-term growth.

What is CARICOM?

CARICOM, or the Caribbean Community, is a political and economic union of Caribbean nations working together to develop the region. It comprises 15 full members and five associate members, representing both island nations and mainland territories like Belize. CARICOM countries collaborate to strengthen their economies, develop regional strategies, and respond collectively to global issues.

The Secretariat, headquartered in Guyana, functions as the administrative backbone, coordinating decisions made by member states. CARICOM organizations play vital roles in specialized sectors, such as the Caribbean Public Health Agency (CARPHA) in health and the Caribbean Examination Council (CXC) in education. As a unifying entity, CARICOM encourages collective efforts to overcome obstacles like trade barriers and natural disasters, bolstering regional resilience.

Goals of the Caribbean Community

CARICOM’s goals center on deepening economic ties, improving citizens’ well-being, and fostering social and cultural cohesion. Initiatives include the CARICOM Single Market and Economy (CSME), which facilitates the free movement of goods, services, and skilled labor across member states like St. Lucia, Suriname, and Dominica. This economic integration boosts competitiveness and creates opportunities for local businesses.

In health, CARICOM promotes collaborative approaches to combat diseases and improve access to healthcare services. Education initiatives focus on harmonizing academic standards through organizations like CXC. CARICOM countries also advocate for environmental sustainability, advancing renewable energy adoption and disaster risk management.

By supporting such objectives, CARICOM fosters unity and shared progress among its diverse members.

Historical Background of CARICOM

CARICOM, established in 1973 through the Treaty of Chaguaramas, evolved from earlier regional efforts to promote collaboration. The Caribbean Free Trade Association (CARIFTA), founded in 1965, served as its immediate predecessor, focusing on fostering economic integration among Caribbean nations. CARICOM’s creation marked a shift toward a more unified approach, addressing broader regional issues beyond trade.

Its founding members included Barbados, Guyana, Jamaica, and Trinidad and Tobago, with additional nations joining over time to form 15 full member states. These CARICOM members represent a diverse group of countries, varying in size, economy, and culture, yet sharing common regional goals. This diversity underlines the organization’s mission to support the collective progress of the Caribbean Community.

Through its history, CARICOM has played a pivotal role in uniting member states to tackle challenges such as trade barriers, poverty, and economic disparities. Initiatives like the CARICOM Single Market and Economy (CSME) exemplify the organization’s long-term commitment to creating a seamless economic space, enabling the free movement of goods, services, capital, and skilled labor. These efforts reflect CARICOM’s ongoing strategy to strengthen the economic foundations of the region.

Education and health have been central to CARICOM’s collaborative agenda. Regional projects like the Caribbean Examinations Council (CXC) standardize education systems, ensuring equal opportunities across CARICOM countries. In health, initiatives such as PANCAP (Pan Caribbean Partnership Against HIV and AIDS) demonstrate how member states join forces to address critical public health issues. Cooperation in these areas highlights CARICOM’s commitment to improving quality of life for its citizens.

CARICOM has also emphasized cultural unity, fostering connections through sports, music, and arts. Events like CARIFESTA (Caribbean Festival of Arts) serve as platforms for cultural exchange and cooperation among the member states. These efforts strengthen the bonds within the Caribbean Community, reinforcing a shared identity amid their diversity.

Membership and Structure of CARICOM

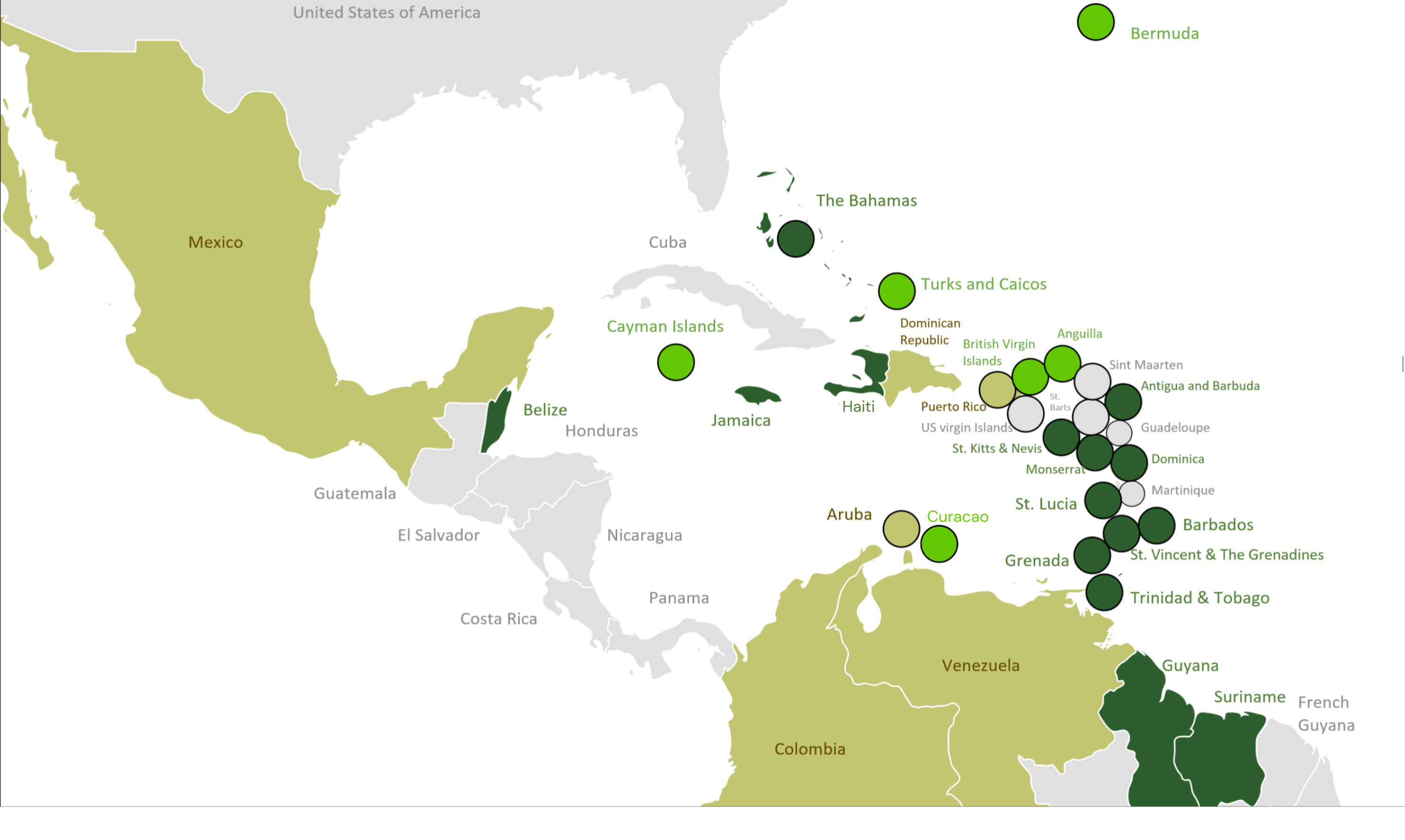

CARICOM consists of 15 member states and five associate members, encompassing a diverse range of territories within the Caribbean. The member states include Antigua and Barbuda, The Bahamas, Barbados, Belize, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Suriname, and Trinidad and Tobago. Associate members include Anguilla, Bermuda, the British Virgin Islands, the Cayman Islands, and the Turks and Caicos Islands.

The governing structure of CARICOM ensures effective decision-making and regional collaboration. The Conference of Heads of Government, the highest decision-making body, provides policy direction and oversees the implementation of the organization’s objectives. The Community Council of Ministers, the second-tier decision-making body, focuses on strategic coordination among CARICOM members.

The Secretariat, headquartered in Georgetown, Guyana, serves as the principal administrative body. It coordinates initiatives across trade, education, and health while facilitating discussions among member states. CARICOM organizations, such as the Caribbean Development Bank and the Caribbean Examinations Council, support the region’s development by implementing specialized programs.

Functional cooperation among CARICOM countries strengthens regional ties. Programs in education, like the Caribbean Examinations Council, standardize academic benchmarks, while health initiatives such as the Pan Caribbean Partnership Against HIV and AIDS improve public health. Trade frameworks, including the CARICOM Single Market and Economy, enhance economic integration by enabling the free movement of goods, services, and people.

Collaborative efforts extend to disaster management, cultural exchange, and sustainable development. Events like CARIFESTA promote cultural unity, reflecting CARICOM’s commitment to fostering shared identity within the Caribbean community. Through its initiatives, CARICOM reinforces regional solidarity while addressing common challenges across its diverse membership.

Key Areas of Regional Collaboration

The Caribbean Community (CARICOM) advances regional unity through cooperation in critical sectors. Collaboration fosters shared growth among CARICOM countries, addressing economic, educational, health, and environmental priorities.

Trade and Economic Integration

Efforts to integrate trade and economies enhance economic resilience among CARICOM members. Through the CARICOM Single Market and Economy (CSME), nations gain seamless access to goods, services, capital, and skilled labor. This initiative supports intra-regional trade and stimulates economic diversification to reduce reliance on external markets.

CARICOM also works toward uniform trade policies, enabling fair competition among member states. By addressing barriers like tariffs and regulations, these measures protect smaller economies in CARICOM countries. Partnerships with external organizations foster access to global markets, strengthening the regional economy.

Education and Skills Development Initiatives

Education reforms across CARICOM members support regional human capital growth. Programs such as the Caribbean Examinations Council (CXC) standardize assessments, ensuring students receive globally recognized qualifications. These initiatives facilitate mobility for citizens pursuing careers or higher education.

Skills development programs focus on vocational training in industries like tourism and agriculture. Institutions collaborate to harmonize curricula, meeting the region’s workforce demands. By investing in education, CARICOM supports sustainable development through a skilled, adaptable workforce.

Healthcare Programs Across Member States

CARICOM countries address regional healthcare challenges by uniting efforts. Programs like the Pan Caribbean Partnership Against HIV and AIDS (PANCAP) tackle epidemics, strengthening public health outcomes. Collaborative mechanisms streamline the procurement of medical supplies, ensuring access to essential resources for all member states.

Regional institutes promote research into diseases affecting Caribbean populations. By sharing expertise, CARICOM organizations enhance healthcare standards. Initiatives also focus on preventive measures, improving long-term well-being across the Caribbean Community.

Environmental and Sustainable Development Efforts

Sustainability initiatives demonstrate CARICOM’s commitment to environmental preservation. Projects focus on addressing climate change risks, such as rising sea levels and extreme weather events. Disaster risk management, including early warning systems, protects communities in vulnerable regions.

CARICOM countries collaborate on renewable energy projects to transition toward greener economies. Reforestation and conservation programs preserve vital ecosystems, ensuring biodiversity protection. These efforts secure sustainable development for CARICOM members, enhancing regional resilience.

Advantages of Strengthening Regional Collaboration

Strengthening collaboration within the Caribbean Community CARICOM supports shared progress and ensures resilience in addressing regional challenges. These efforts provide significant benefits economically, socially, and globally.

Economic Growth and Stability

CARICOM countries benefit from deeper economic integration, which fosters growth and resilience. Initiatives like the CARICOM Single Market and Economy (CSME) enable the free movement of goods, services, capital, and skilled labor across member states. This access boosts business opportunities and reduces import dependency, particularly for smaller economies.

Collective trade policies protect local industries and enhance bargaining power in global negotiations. By minimizing trade barriers among CARICOM members, regional production networks are strengthened. For example, sectors like agriculture, manufacturing, and tourism gain expanded markets and shared resources, leading to enhanced profitability and job creation.

Investment opportunities increase with pooled economic resources and harmonized regulations. Shared financial systems and collaborations attract foreign direct investments, which promote infrastructure development and regional stability.

Enhanced Global Competitiveness

Unified regional actions position CARICOM countries to compete effectively on the global stage. Collaborative trade policies allow for a stronger collective presence in international markets, particularly for exports like Caribbean agricultural products and manufactured goods.

Standardization across CARICOM members reduces inefficiencies and streamlines the production process. For instance, common product certification systems ensure international compliance, boosting the competitiveness of regional exports.

Strategic partnerships with global organizations further strengthen the region’s global reach. By presenting a unified voice in international forums, CARICOM organizations secure better cooperation on global issues like climate change, trade agreements, and regional security, elevating the influence of the Caribbean beyond individual member capabilities.

Social and Cultural Benefits

Enhanced collaboration amplifies social and cultural ties across CARICOM countries. Regional health initiatives, such as the Pan Caribbean Partnership Against HIV and AIDS (PANCAP), improve public health outcomes by addressing shared challenges and promoting resource sharing.

Educational programs like the Caribbean Examinations Council (CXC) create consistent academic standards. These initiatives enhance opportunities for students and make career mobility seamless within member states.

Cultural exchange further unites CARICOM members, fostering a shared Caribbean identity. Events like CARIFESTA highlight the diversity and richness of the region’s cultures, strengthening regional bonds and promoting Caribbean arts on a global stage. By prioritizing these social initiatives, regional collaboration nurtures unity and enhances the well-being of the Caribbean community.

Future Outlook for CARICOM

CARICOM’s future hinges on addressing challenges while leveraging opportunities to achieve deeper regional unity. As the Caribbean Community evolves, efforts focus on strengthening ties among CARICOM members through enhanced collaboration and innovative strategies.

Potential Challenges and Opportunities

CARICOM faces economic, environmental, and governance challenges. Economic disparities among CARICOM countries, like the differences in GDP between larger and smaller states, create uneven development. Vulnerability to climate change impacts, including hurricanes and rising sea levels, threatens socio-economic stability, particularly for island nations. Limited access to financial resources and global trade competition also constrain growth.

Despite these obstacles, opportunities exist. Expanding the CARICOM Single Market and Economy (CSME) can boost trade and attract investments. Prioritizing renewable energy initiatives reduces dependency on fossil fuels, tackling environmental concerns. Strengthening partnerships with global organizations enhances technical and financial support for disaster resilience and economic diversification. Leveraging CARICOM organizations facilitates unified strategies to address shared challenges and pursue sustainable development goals.

Vision for Deeper Integration and Cooperation

Deeper integration among CARICOM members aims to create a more unified and resilient Caribbean Community. Expanding free movement of people and services within CARICOM countries under the CSME strengthens economic ties and fosters job creation. Harmonizing trade policies and legal frameworks encourages smoother cross-border operations. Collaborative educational reforms, such as advancing standardized curricula through the Caribbean Examinations Council (CXC), improve academic mobility and workforce competence.

In health, scaling regional initiatives like the Pan Caribbean Partnership Against HIV and AIDS (PANCAP) ensures equitable access to healthcare. Promoting cultural exchange programs, including events like CARIFESTA, reinforces shared Caribbean identity. By fostering innovation, sustainable practices, and socio-economic collaboration, CARICOM enhances its collective strength and global competitiveness.

Conclusion

CARICOM represents a powerful force for unity and progress in the Caribbean, driving collaboration across diverse nations to address shared challenges and create opportunities. Its commitment to economic integration, cultural exchange, and sustainable development strengthens regional ties and fosters resilience.

As CARICOM continues to evolve, its focus on innovation, collective action, and deeper integration ensures a brighter future for its member states. By working together, the Caribbean Community builds a stronger, more unified region that benefits all its citizens.