Managing significant wealth comes with unique challenges, and that’s where family office wealth management steps in. It’s more than just overseeing finances—it’s about preserving legacy, protecting assets, and ensuring long-term growth for generations. Whether you’re navigating investments, tax planning, or philanthropic goals, a family office provides tailored solutions to meet your family’s needs.

You might wonder why this approach is gaining traction. As financial landscapes grow more complex, families with substantial assets are seeking personalized strategies that go beyond traditional wealth management. A family office offers a centralized framework to handle everything from estate planning to risk management, giving you peace of mind.

By adopting a holistic approach, family office wealth management ensures your family’s values align with financial decisions. It’s not just about growing wealth—it’s about creating a sustainable future while simplifying the complexities of managing it all.

Family Offices and Wealth Management: Diversifying with Caribbean Real Estate

Caribbean real estate offers unique opportunities for family offices seeking to diversify portfolios and manage wealth effectively. These investments can reduce risks while complementing traditional asset classes, creating a stronger financial foundation.

Introduction to Family Offices and Wealth Management

Family offices provide tailored wealth management solutions to affluent families. They focus on sustaining and growing wealth across generations by incorporating diverse asset strategies that align with family goals.

What are Family Offices?

Family offices are entities managing the financial assets, legal affairs, and estate planning of high-net-worth families. Single-family offices handle the needs of one family, while multi-family offices serve multiple families. Both models aim to ensure that investments, such as real estate, support legacy preservation and long-term growth.

Importance of Diversification in Wealth Management

Diversification is critical in safeguarding wealth against market volatility. By including non-correlated asset classes like Caribbean real estate, family offices can mitigate risk. These markets often remain stable compared to developed regions like the US, Canada, Europe, and Asia, increasing their appeal for family office real estate investors. Resorts, luxury villas, and commercial properties across the Caribbean provide avenues to balance portfolios and explore alternative revenue streams.

Real estate investments in this region can act as a hedge while contributing to an adaptable and resilient wealth management strategy for family office management.

Overview of Caribbean Real Estate Markets

Caribbean real estate presents a compelling opportunity for diversifying family office portfolios. Properties in this region offer unique advantages like susceptibility to less market volatility and alignment with long-term wealth goals.

Non-Correlation with Developed Markets

Caribbean real estate markets generally operate independently from developed markets like the US, Canada, Europe, and Asia. This non-correlation reduces exposure to global economic fluctuations, which safeguards wealth during periods of instability. For example, while equity markets in developed regions often fluctuate based on macroeconomic trends, Caribbean real estate values tend to remain stable, particularly in the luxury property and resort segments.

Family office real estate investment in the Caribbean minimizes the overdependence on traditional asset classes like equities or domestic real estate. Adding Caribbean properties ensures portfolio resilience by balancing risks associated with cyclical downturns in developed economies.

Unique Opportunities in the Caribbean

Real estate investment in the Caribbean comes with access to exclusive opportunities. Prime locations offer high-value options like beachfront villas, boutique hotels, and residential resorts, attracting affluent buyers. These assets not only appreciate in value but also generate recurring income through vacation rentals and luxury tourism-driven demand.

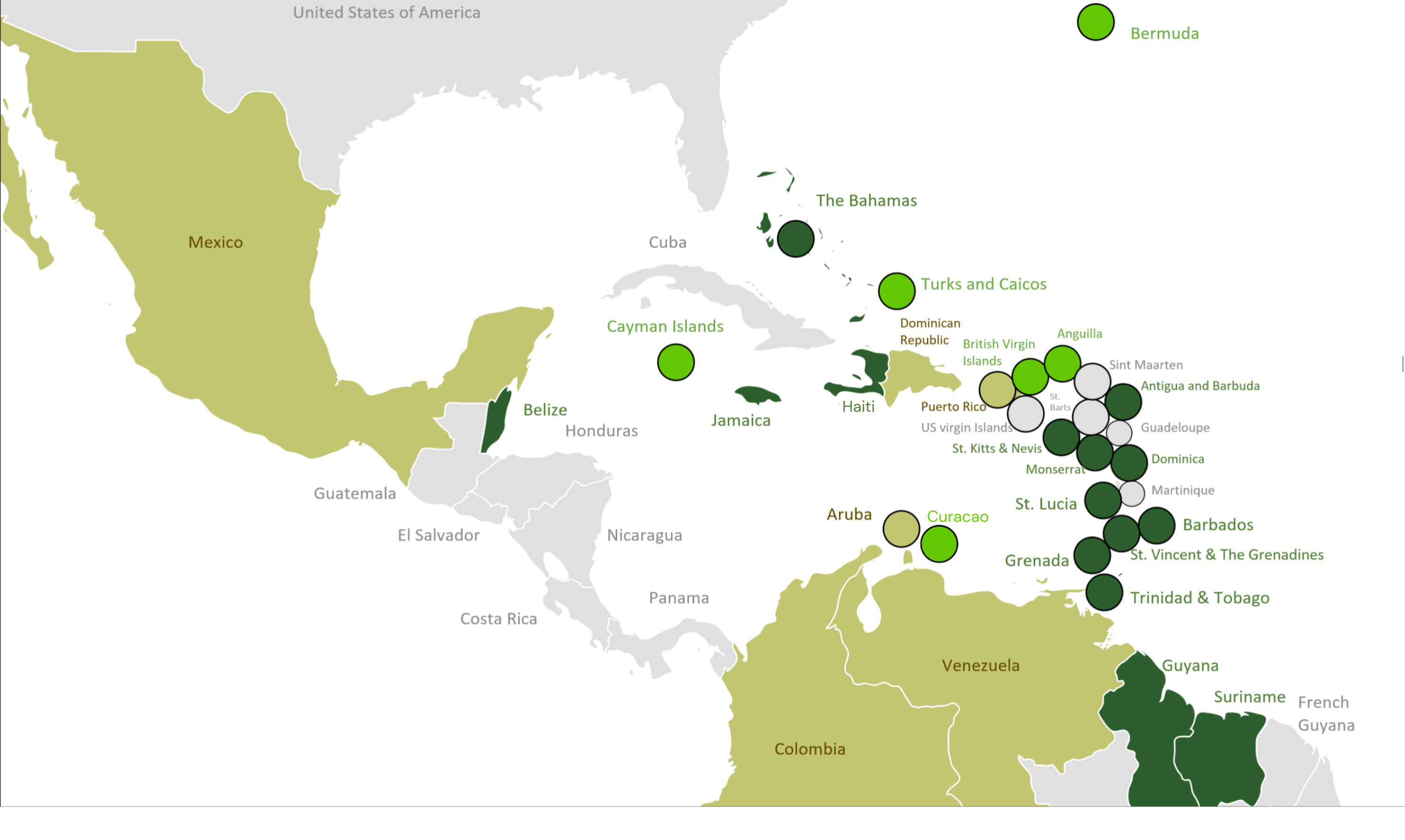

Several Caribbean nations, such as the Bahamas and Turks and Caicos, provide investor-friendly regulations, making it easier for family office real estate investors to acquire and manage properties. Citizenship-by-investment programs also enhance property value by offering additional benefits like global mobility. This combination of regulatory ease and high demand allows you to position your portfolio for both short-term income and long-term growth potential.

Benefits of Caribbean Real Estate for Family Office Portfolios

Investing in Caribbean real estate enhances portfolio diversification and fortifies risk management strategies for family office real estate investors. These markets complement traditional asset classes and contribute to building a sustainable, growth-oriented portfolio.

Portfolio Diversification and Risk Management

Caribbean real estate provides a hedge against risks in highly correlated global markets. These properties, including beachfront homes and luxury resorts, operate independently from developed markets in the US, Canada, Europe, and Asia. By investing in this region, you mitigate economic shocks that can impact traditional asset classes like equities or bonds. Diversifying across these non-correlated markets strengthens portfolio stability and resilience.

Stable Returns and Long-Term Growth Potential

Caribbean real estate offers consistent revenue streams and long-term value appreciation. Rental income from boutique hotels or luxury villas contributes to stable returns, while limited supply in prime locations ensures property appreciation over time. The region’s popularity as a global luxury destination supports steady demand, aligning these investments with long-term wealth objectives for family office real estate investment strategies.

Tax Efficiency and Wealth Preservation Strategies

Several Caribbean nations offer investor-friendly tax policies that help preserve wealth. By acquiring real estate in these jurisdictions, you reduce tax exposure and improve after-tax returns. Many markets provide incentives such as favorable capital gains or property tax rates, aligning with family office management strategies focused on sustaining multi-generational wealth. These tax efficiencies enhance the appeal of integrating Caribbean real estate into your portfolio.

Key Strategies for Family Office Investments in the Caribbean

Family offices often explore Caribbean real estate to diversify holdings and protect against risk. These markets, independent from developed economies in the US, Canada, Europe, and Asia, complement traditional assets and offer stability for wealth portfolios.

Identifying High-Value Markets

Focus on prime locations in the Caribbean to maximize returns. Areas like the Bahamas, Barbados, and Saint Lucia attract high demand due to their luxury tourism appeal. Consider markets with strong rental potential, investor-friendly laws, and consistent value appreciation. High-value areas often feature beachfront villas, boutique hotels, and resort properties that align with family office real estate investment goals.

Balancing Residential and Commercial Properties

Create a balanced portfolio by including both residential and commercial assets. Residential properties, such as luxury villas or condominiums, assure consistent rental income during tourism seasons. Commercial real estate, like boutique hotels or office spaces, diversifies income streams and reduces risk exposure. Balancing these property types strengthens your overall family office management strategy while offering adaptable revenue sources.

Leveraging Local Expertise and Partnerships

Collaborate with local real estate professionals to navigate market-specific regulations and identify high-potential investments. Partner with property managers, legal consultants, and real estate agents experienced in family office real estate investors’ needs. These partnerships simplify acquisition processes, ensure compliance, and enhance portfolio performance through informed decision-making.

Case Studies of Successful Caribbean Real Estate Investment Portfolios

For family offices seeking to preserve wealth while accessing meaningful growth, the Caribbean offers a unique blend of resilience, yield, and strategic diversification. Below are two case studies that reflect how real estate investment in the region—when executed with long-term vision and local engagement—can become a cornerstone of multigenerational wealth planning.

Dart Group – Cayman Islands

The Dart Group, headquartered in the Cayman Islands, provides a compelling model of how real estate can be used to unlock lasting value across generations. Known for developing Camana Bay, a fully integrated commercial and residential hub, Dart has demonstrated how mixed-use assets can produce stable, diversified income streams that align with family office objectives.

More recently, Dart has expanded its portfolio beyond Cayman, acquiring the prestigious Four Seasons Resort and Residences Anguilla. This move signals a broader appetite for institutional-grade, branded residences in premium Caribbean markets. The acquisition of Anguilla’s Zemi Beach House in 2024 further illustrates Dart’s strategy of consolidating top-tier hospitality assets under long-term stewardship.

What makes Dart’s approach especially relevant for family offices is its commitment to infrastructure and community uplift. Following its resort acquisitions, the group pledged $5 million toward cultural development in Anguilla, enhancing long-term asset value while contributing to local economic resilience. For family offices that view wealth as both a legacy and a responsibility, Dart offers a textbook example of capital being deployed with foresight and impact.

Ayre Group – Antigua and Barbuda

Founded by Calvin Ayre—a Canadian entrepreneur who gained global recognition through his early work in online gaming—the Ayre Group demonstrates a more entrepreneurial but equally instructive path for family offices. Now a citizen of Antigua and Barbuda, Ayre has redirected his efforts into Caribbean real estate, blockchain ventures, and philanthropy.

In the property space, the Ayre Group is developing a $400 million Nikki Beach resort and branded residences in Antigua’s Jolly Harbour, with completion expected by 2028. This development targets high-net-worth individuals seeking luxury assets with lifestyle and citizenship utility. A separate $40 million project, Vida Del Ayre, is nearing completion as a private hilltop business and wellness retreat—designed to serve elite executive clients and their families.

What sets Ayre’s model apart is how it strategically aligns with Antigua and Barbuda’s Citizenship by Investment Program. By offering real estate that qualifies for CBI, the group taps into a global pool of investors seeking both asset diversification and enhanced mobility. For family offices, this illustrates how regulatory insight and global citizenship trends can be woven into a broader real estate strategy.

Ayre’s philanthropic focus, especially through the Calvin Ayre Foundation, reinforces a central theme in family office wealth management: impact and legacy. From supporting education and healthcare to rebuilding efforts after natural disasters, the foundation’s work reflects the values-driven dimension of modern family office stewardship.

Conclusion

Family office wealth management offers a strategic pathway to preserve and grow your family’s legacy while navigating today’s complex financial landscape. By incorporating diverse investments like Caribbean real estate, you can strengthen your portfolio, mitigate risks, and achieve sustainable growth for generations to come.

With its unique advantages and potential for stable returns, the Caribbean real estate market presents an invaluable opportunity for families seeking to align their financial goals with long-term resilience. Leveraging local expertise and carefully selecting high-value properties can position your family office for enduring success.