The real estate and investment landscape in St. Kitts & Nevis has just experienced a major shift. In a landmark announcement, Safe Harbor Marinas—the largest owner and operator of marinas in the world—has acquired The Marina at Christophe Harbour, the long-stalled superyacht marina on St. Kitts’ southeast peninsula. This acquisition follows the $5.65 billion purchase of Safe Harbor itself by Blackstone Infrastructure, bringing significant institutional backing to the Caribbean’s luxury marine and property sectors.

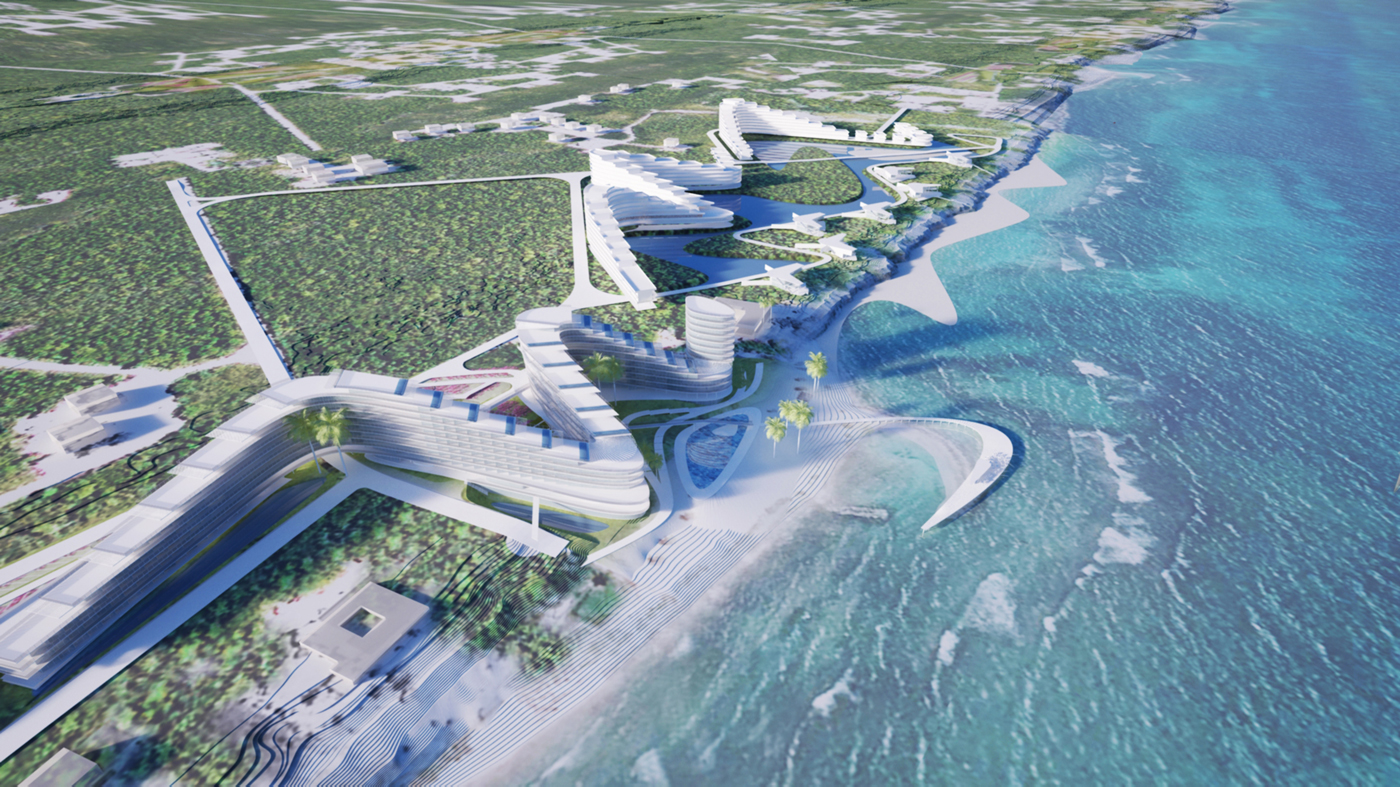

Christophe Harbour St. Kitts, once one of the most ambitious master-planned communities in the region, had been largely dormant for the past decade. With this new partnership in place, momentum has returned. Safe Harbor plans a major expansion of the marina to accommodate vessels up to 107 meters, alongside upgraded infrastructure that will better connect St. Kitts and Nevis to the global yachting circuit.

This marks a pivotal moment not only for Christophe Harbour but for the broader narrative of investment migration and ultra-luxury living in the Caribbean. Investors have long watched Christophe Harbour with interest, waiting for the project to fulfill its original promise. With Safe Harbor’s entry, that promise may finally be realized.

History and Challenges of Christophe Harbour

The story of Christophe Harbour St. Kitts is one of bold vision, international ambition, and long-term complexity. Launched by American entrepreneur Charles “Buddy” Darby III, Christophe Harbour was envisioned as a luxury, master-planned marina and residential resort community capable of competing with the likes of St. Barths, the Bahamas, and the Cayman Islands.

Darby was no stranger to resort development. He had previously made his name with Kiawah Island, a high-end golf and resort enclave near Charleston, South Carolina, known for its upscale homes, eco-conscious planning, and world-class golf. With Christophe Harbour, Darby brought the same commitment to quality and exclusivity, selecting the unspoiled southeast peninsula of St. Kitts as the canvas for his next great development.

Launched in the mid-2000s, Christophe Harbour received immediate attention from investors and yachting elites. The development included ambitious plans for a superyacht marina, private beach clubs, luxury residences, a Tom Fazio-designed golf course, and even a Park Hyatt hotel. Darby and his team invested heavily in infrastructure, including customs and immigration facilities within the marina, positioning Christophe Harbour as a hub for ultra-high-net-worth visitors.

However, despite its early momentum, the project faced mounting challenges. The 2008 global financial crisis significantly disrupted the luxury development sector, and Christophe Harbour struggled to regain its early traction. Sales slowed, infrastructure outpaced absorption, and the expected flurry of new homebuilding never fully materialized. The ambitious scale of the project, while visionary, became difficult to execute without broader market tailwinds.

Over the past decade, much of Christophe Harbour remained underutilized. While the marina did open and host impressive vessels, many of the surrounding neighborhoods saw only modest home construction. Still, the land remained valuable, the core infrastructure world-class, and the vision intact—awaiting the right partner to carry it forward.

Enter Safe Harbor Marinas, with their operational expertise, global portfolio, and strong financial backing. Their acquisition brings a renewed sense of credibility and momentum to Christophe Harbour. It also marks a strategic shift—moving from founder-led passion to institutional stewardship, with a focus on maximizing value for homeowners, investors, and the Federation as a whole.

What This Means for St. Kitts & Nevis Real Estate

This transaction represents more than a marina acquisition—it’s a powerful signal that St. Kitts & Nevis is stepping into a new era of global relevance. With the entrance of Safe Harbor Marinas and their institutional scale and operational track record, confidence in the Federation’s luxury property sector has never been higher.

The implications for real estate are both immediate and long-term:

- Christophe Harbour real estate is expected to experience a significant rise in value, as renewed infrastructure development boosts confidence and enhances the quality of life and service delivery.

- The region is seeing a growing wave of inquiries from North American and European buyers looking for both second homes and long-term investments in high-quality Caribbean communities.

- Private developers and landowners across St. Kitts and Nevis are also poised to benefit, as interest spills over into adjacent regions and established neighborhoods.

In short, this is more than a localized investment. It’s a catalyst that could reshape buyer behavior, developer strategy, and national positioning within the Caribbean’s luxury property sector.

Spotlight on Four Seasons Nevis

The revival of Christophe Harbour brings new attention to Four Seasons Nevis, the only fully operational, internationally branded resort community in the Federation. With nearly 100 private residences already completed and two new projects—Nevis Peak Residences and Villas at Pinney’s Beach—already under construction, Four Seasons is well positioned to absorb growing demand.

As other regional developments remain years away, Four Seasons Nevis offers immediate lifestyle access, resort services, and Citizenship by Investment (CBI) eligibility—making it the clear choice for buyers seeking credibility and convenience. new life into Christophe Harbour, it also adds fuel to the fire at Four Seasons Nevis. As the only internationally branded resort community currently operational in the country, Four Seasons Nevis is now uniquely positioned to absorb demand from investors seeking luxury, credibility, and immediate access to Caribbean lifestyle.

Every other comparable development in the region is five to ten years away from completion. In contrast, Four Seasons Nevis offers buyers move-in ready homes, full resort amenities, and strong resale potential—making it the clear choice for those looking to act now.

As capital and attention flow back into The Marina at Christophe Harbour, Nevis stands to benefit tremendously. We anticipate accelerated interest and price growth in the luxury segment as a result.

Four Seasons Nevis is also the only real estate development in the Federation currently delivering Citizenship by Investment shares within a fully built, internationally operated resort setting. For global families balancing financial security, lifestyle access, and second citizenship, the choice is becoming increasingly clear.

A Regional Turning Point

This acquisition was made possible through the support of the Government of St. Kitts and Nevis, the Darby family (original visionaries behind Christophe Harbour), and key diplomatic figures including Special Envoy Her Excellency Hadiya Claxton. Prime Minister Dr. Terrance Drew has called the transaction a “catalyst for long-term economic growth and international recognition.”

The Christophe Harbour Development Company will continue to manage the residential components of the site, while Safe Harbor Marinas takes over operations of the marina itself, integrating it into its global portfolio of over 135 properties.

The return of serious capital and credible operators to Christophe Harbour represents a turning point not only for the project itself, but for the trajectory of luxury real estate in St. Kitts & Nevis. For investors, Citizenship by Investment applicants, and global families looking for secure second homes in the Caribbean, now may be the time to take a closer look.

What This Means for the Future of the Market

The revitalization of Christophe Harbour signals more than just a single project getting back on track—it represents a broader reawakening of the St. Kitts and Nevis real estate market. With renewed investment, institutional oversight, and long-overdue momentum, the Federation is entering a new chapter of credibility and global relevance.

This moment offers a rare opportunity for buyers, developers, and landowners alike:

- Land value appreciation is expected across the Southeast Peninsula and in adjacent high-end communities, particularly those with infrastructure in place.

- Luxury housing inventory, especially at Four Seasons Nevis and in future phases of Christophe Harbour, is likely to tighten as regional attention grows.

- Resale and rental potential will be bolstered by rising tourism, enhanced marina traffic, and broader infrastructure improvements.

Perhaps most importantly, the Safe Harbor acquisition proves that top-tier global investors see long-term value here. As other island jurisdictions face delays or political uncertainty, St. Kitts and Nevis now offers something rare: stability, delivery, and vision—at exactly the right time.

Final Thoughts

Christophe Harbour’s next chapter is already underway, and with it, the future of real estate in St. Kitts and Nevis is evolving quickly. What was once seen as a dormant asset is now becoming a beacon for growth, tourism, and high-quality development in the Caribbean.

Whether you’re a buyer considering your first property in the Federation, a developer seeking land with strong fundamentals, or simply someone following the transformation of the Eastern Caribbean, the message is clear: this is a rare moment of alignment—vision, capital, and infrastructure are finally in place.

From the hills of Nevis to the coastlines of the Southeast Peninsula, the real opportunity isn’t just what’s coming next—it’s what’s already happening.