Dreaming of living in a tropical paradise? Barbados residency by investment offers you the chance to call this stunning Caribbean island home. With its pristine beaches, vibrant culture, and favorable tax benefits, Barbados has become a sought-after destination for individuals and families looking to combine luxury living with smart financial planning.

By investing in Barbados, you’re not just securing residency—you’re gaining access to a stable economy, excellent infrastructure, and a welcoming community. Whether you’re drawn by the island’s relaxed lifestyle or its growing opportunities for business and investment, Barbados provides the perfect balance of work and play.

This program is ideal if you’re seeking a straightforward path to residency while enjoying the perks of a world-class destination. From real estate investments to government-approved options, Barbados offers flexible pathways tailored to your goals. It’s time to turn your dream of island living into reality.

How to Obtain Barbados Residency by Investment: A Comprehensive Guide

Barbados offers attractive opportunities for individuals seeking residency through investment. From structured investment programs to leveraging regional agreements, the process is both strategic and rewarding.

What is the Barbados SERP Program?

The Barbados Special Entry and Reside Permit (SERP) program allows qualifying individuals to obtain residency by investment. By meeting financial eligibility criteria, you can secure your right to reside on the island.

- Eligibility Requirements: Individuals with a net worth of at least $5 million qualify for SERP. Proof of financial resources is mandatory.

- Application Process: You need to submit an application with verification documents, including proof of net worth, identity documents, and fees. Processing times vary but are efficient compared to similar programs.

SERP grants you extended residency validity without requiring physical presence on the island. If you’re interested in maintaining global mobility with a Caribbean base, this is a viable route.

Key Benefits of Residency in Barbados for Investors

Investing in Barbados residency provides numerous financial and personal advantages.

- Tax Incentives: Barbados offers favorable tax rates. There’s no inheritance tax or capital gains tax, further increasing its appeal.

- Global Networks: Access to CARICOM allows you to connect with other regional markets. The CARICOM passport, obtainable through citizenship in one of five member states, enables smooth travel and business expansion.

- Lifestyle Benefits: High living standards, world-class education, and healthcare are key perks. You’ll experience stable governance and a welcoming environment.

Residency ensures your family benefits from secure, long-term living conditions while offering strategic advantages for business operations.

Why Choose Barbados as Your Investment Destination

Barbados combines economic potential with an unparalleled lifestyle, making it a leading investment destination in the Caribbean.

- Access to Regional Mobility: Acquiring citizenship in a CARICOM member state, such as St. Kitts, Antigua, or Dominica, offers you a CARICOM passport. With this, you can leverage the skills certificate or rights of establishment for residency in Barbados.

- Strong Economy: The island’s diversified economy, with thriving tourism, international business, and financial services sectors, ensures stability for investors.

- Quality of Life: Beaches, vibrant culture, and year-round tropical climate make Barbados attractive for families and retirees.

Barbados provides a pathway to residency filled with benefits and opportunities for growth, whether through the SERP program or regional strategies.

Investment Pathways to Residency in Barbados

Securing Barbados residency through investment combines lifestyle benefits with financial opportunities. Multiple pathways allow investors to align with their goals while fulfilling Barbados residency requirements.

Top Investment Routes: Real Estate, Business, and Beyond

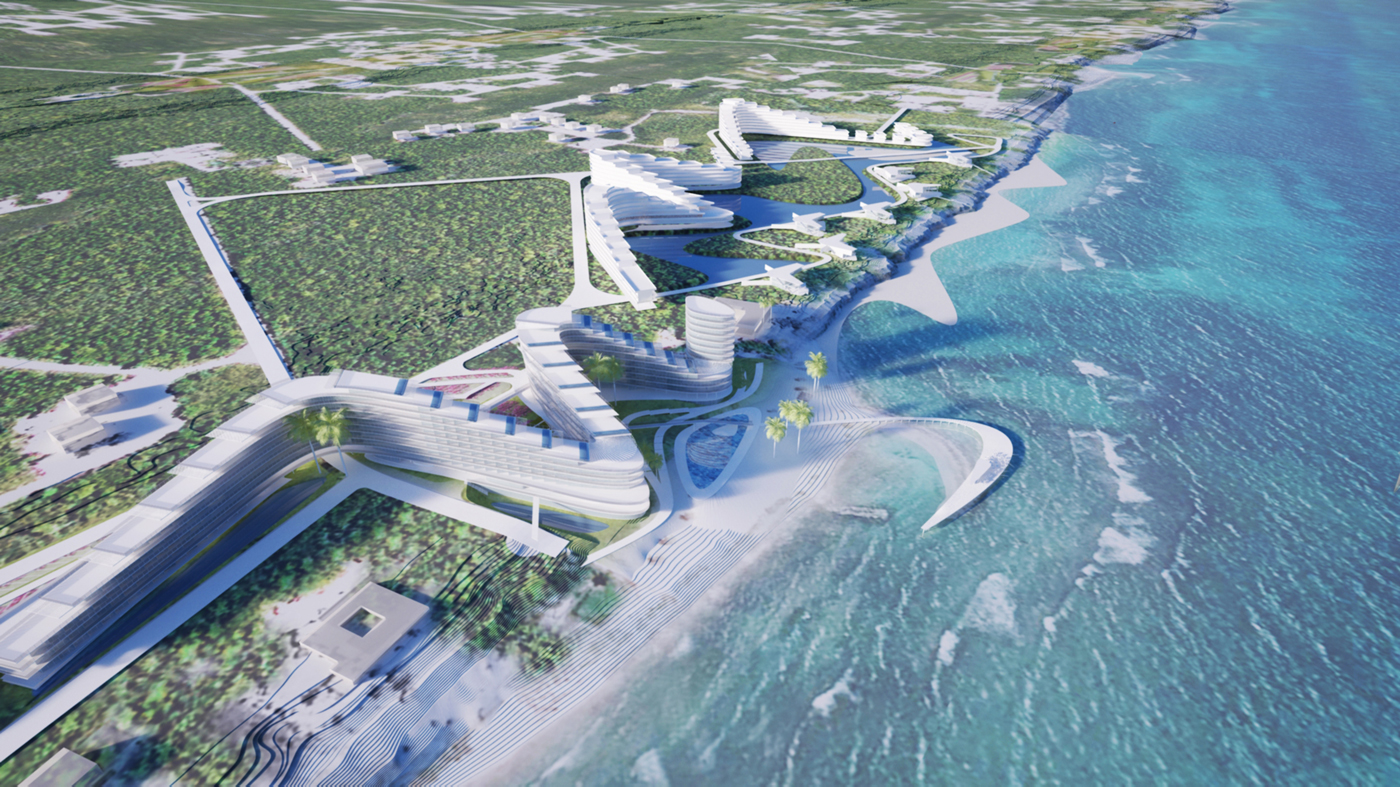

Real estate investments are the most prominent route to obtaining Barbados residency. By purchasing high-value properties, you can fulfill the criteria for residency applications. Upscale beachfront homes and luxury apartments are favored options, drawing buyers seeking access to the island’s premier locations.

Business investments also unlock residency opportunities. Establishing or significantly investing in local enterprises creates economic contributions, aligning with government priorities. This route can benefit entrepreneurs aiming to capitalize on Barbados’s stable economy.

Alternative methods include securing Barbados residency indirectly. Acquiring citizenship in one of the five Caribbean nations offering citizenship by investment (St. Kitts & Nevis, Dominica, Grenada, St. Lucia, Antigua & Barbuda) allows you to utilize a CARICOM passport. With the CARICOM Skills Certificate or Rights of Establishment, this facilitates legal residency in Barbados under regional agreements.

Step-by-Step Process for Securing Barbados Residency

- Determine Eligibility: Meet Barbados residency requirements via financial or business investments or qualify through alternative CARICOM pathways.

- Select the Investment Type: Choose between real estate, local business ventures, or foreign investment partnerships.

- Complete Due Diligence: Prepare verified financial statements and ensure your investment aligns with legal and economic obligations in Barbados.

- Apply Through SERP or Conventional Residency Options: If applicable, pursue the Special Entry and Reside Permit (SERP), requiring a minimum net worth of $5 million. Submit the necessary application.

- Obtain Approval: Transition into residency status after receiving approval, enabling you to access the privileges of Barbados permanent residence.

If entering via a CARICOM passport, pursue recognition under the Skills Certificate agreement, simplifying the transition to Barbados residency.

- Proof of Investment: Provide contracts, deeds, or agreements as evidence of real estate or business contributions.

- Financial Verification: Submit bank statements, net worth certifications, or proof of guaranteed resources for SERP eligibility.

- Identification and Civil Records: Supply a valid passport, birth certificate, and marital status documentation.

- Health Certifications: Deliver medical clearance to confirm fitness, meeting public health standards.

- Background Checks: Include police clearance records to demonstrate compliance with residency laws and security protocols.

For CARICOM pathways, present your CARICOM passport, Skills Certificate, and supporting documents verifying regional eligibility under the agreement. These ensure a compliant and efficient approval process for residency.

Unlocking Barbados Residency Through Citizenship by Investment

Barbados residency becomes accessible through indirect pathways such as Caribbean citizenship programs. By leveraging CARICOM agreements, you can secure residency in Barbados using specific mechanisms like the CARICOM Passport and Skills Certificate.

Overview of Caribbean Citizenship by Investment Programs

Five Caribbean nations offer citizenship by investment: Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, and Saint Lucia. These programs grant second citizenship in exchange for qualifying investments such as real estate purchases or contributions to government funds. Investment thresholds typically range from $100,000 for individual applicants to higher amounts depending on family size.

Obtaining Caribbean citizenship facilitates access to the CARICOM Passport. This document allows free movement and residency across member states, offering a streamlined option if you’re exploring how to get residency in Barbados. After acquiring citizenship in one of these countries, you can use CARICOM privileges to pursue Barbados residency without solely relying on the island’s direct investment-based routes.

How to Use the CARICOM Passport for Residency in Barbados

The CARICOM Passport simplifies regional mobility, enabling you to reside, work, and establish a business in Barbados. Once you acquire citizenship from another CARICOM member state, you’re eligible to apply for Barbadian residency under the Rights of Establishment agreement.

Using this pathway bypasses certain direct Barbados residency requirements like investment in local properties. Instead, your CARICOM nationality allows you to move to Barbados for employment or economic activities. This method suits individuals aiming for continuous access to the country while benefiting from their CARICOM citizenship.

Navigating the CARICOM Skills Certificate and Rights of Establishment

The CARICOM Skills Certificate further supports your residency in Barbados if you hold professional qualifications or work experience recognized within CARICOM member states. This certificate is designed for skilled individuals, including teachers, media workers, and medical professionals, seeking permanent residence or the right to work.

Through the Rights of Establishment, you can set up a business or provide professional services in Barbados. Coordination with Barbados’s immigration authorities ensures compliance while transitioning your CARICOM status into full residency privileges. This route is particularly effective for leveraging your CARICOM citizenship to meet Barbados residency goals.

Benefits of Living in Barbados as a Resident

Barbados residency offers a blend of lifestyle and economic perks for individuals seeking permanent residence. From tax efficiency to regional privileges, it supports both personal and business goals.

Tax-Efficient Living in a Stable Economy

Barbados combines a stable economy with a tax-efficient framework for residents. Its residency programs include reduced tax obligations, such as no capital gains tax. Barbados residency also offers income tax rates as low as 12.5% based on earnings over $50,000 annually for qualifying residents. Double taxation treaties with over 30 countries, including the US and UK, further enhance tax efficiency.

Economic stability bolsters investment outcomes. Barbados’s robust financial sector and governance ensure that your assets remain secure, providing additional value for foreign investors. The absence of inheritance tax benefits long-term financial planning, making Barbados an ideal location for wealth preservation.

Access to World-Class Healthcare and Education

Barbados offers residents access to modern healthcare facilities and international education institutions. Its QEH (Queen Elizabeth Hospital) and private clinics deliver advanced healthcare services. Additionally, medical tourism options like specialized treatments are available to residents.

Educational institutions, such as The University of the West Indies, cater to diverse academic pathways. K-12 schools like Codrington International School provide residents IB-certified curriculums, ensuring global standards. This access to exceptional life services enhances your quality of living significantly.

Travel and Business Advantages in the CARICOM Region

Barbados residency links you to the CARICOM network, granting seamless movement and trade access. The CARICOM Passport allows visa-free travel across 15 member states, including popular hubs like Trinidad and Jamaica. This regional integration enhances mobility for both leisure and work.

Barbados permanent residence offers business advantages too. Through the Rights of Establishment agreement, you can set up enterprises across CARICOM countries without complex regulations. These economic partnerships create a foundation for expanding your business regionally.

Key Challenges and Solutions for Barbados Residency Applicants

Legal and Compliance Considerations for Investors

Meeting Barbados residency requirements involves adhering strictly to legal and compliance standards. You must confirm the legitimacy of your investment sources, as authorities mandate detailed financial transparency. Documentation such as financial statements, identification, and proof of funds is necessary for eligibility verification. Avoid delays by ensuring that submitted paperwork aligns with Barbados’s residency and immigration laws.

Compliance issues arise if investments don’t meet set thresholds or categories, like real estate or business ventures. Barbados stipulates specific residency pathways tied to pre-approved investment types. To secure residency, engage legal advisors to navigate these laws and prevent missteps. CARICOM Passport holders utilizing free-movement benefits also need to align their professional activities with residency obligations under the Right of Establishment Agreement.

Mitigating Investment Risks in the Barbados Market

Investment risks in the Barbados market, including real estate depreciation or market fluctuations, could affect residency outcomes. Research local market trends to determine the stability of preferred investment assets like luxury beachfront properties or commercial ventures. Poor due diligence on these assets or inadequate valuation reports increases the likelihood of financial risk.

Policy or tax regulation changes could impact returns. Barbados offers tax advantages like no capital gains tax, but clarifying implications of indirect costs or fees ensures effective planning. Invest in diversified portfolios and seek regions with high economic growth on the island to reduce dependence on one property or market sector. Working with local market experts strengthens confidence in long-term positive outcomes.

Partnering with Experienced Advisors for a Smooth Process

Securing Barbados residency, especially through investment, requires expert guidance for streamlined processing. Experienced advisors provide insights into navigating government protocols or meeting Barbados residency requirements effectively. These professionals assist in verifying investment suitability and aligning it with legislative criteria, be it through real estate acquisitions or direct entrepreneurial ventures.

Efficient application handling minimizes rejection risks. Advisors familiar with CARICOM Passport pathways ensure seamless transitions, including compliance under the Skills Certificate or Rights of Establishment framework. Ensure the advisor specializes in Barbados’s residency laws and maintains a history of producing quick, reliable results. Transparent collaboration saves time, protects investments, and enhances the overall application experience.

Conclusion

Barbados offers a unique opportunity to combine investment with an exceptional lifestyle in one of the Caribbean’s most desirable locations. Whether you’re seeking tax efficiency, a stable economy, or access to world-class amenities, residency in Barbados provides unmatched benefits for individuals and families alike.

By exploring the various pathways available, from real estate investments to CARICOM agreements, you can find an option that aligns with your goals. With the right guidance and thorough planning, securing residency in Barbados is a seamless process that opens the door to a vibrant community and endless possibilities.

Frequently Asked Questions

What is the main benefit of obtaining residency in Barbados through investment?

The main benefit is access to a high quality of life, including tax advantages, world-class healthcare, and education. Additionally, residency provides a gateway to regional markets through CARICOM and allows for profitable investment opportunities in a stable economy.

What are the investment options to secure Barbados residency?

The most popular investment option is real estate, including luxury beachfront properties. Business investments and alternative methods through CARICOM agreements, such as Caribbean citizenship programs, also qualify.

What is the Barbados Special Entry and Reside Permit (SERP)?

The SERP program allows individuals with a net worth of at least $5 million to obtain Barbados residency. The application requires financial documentation and grants extended residency with no physical presence requirement.

What documents are required for a Barbados residency application?

Applicants need proof of investment, financial verification, identification documents, health certifications, and background checks. Compliance with Barbados residency laws is essential.

How does the CARICOM Passport facilitate residency in Barbados?

The CARICOM Passport allows free movement across member states. By obtaining citizenship in a CARICOM nation, individuals can leverage the agreement to secure Barbados residency.

What tax benefits do Barbados residents enjoy?

Barbados residents benefit from no capital gains tax, reduced income tax rates for qualifying individuals, and no inheritance tax. These advantages make it an appealing destination for financial planning.

Can skilled professionals obtain Barbados residency?

Yes, skilled professionals can secure residency through the CARICOM Skills Certificate, which supports work and business establishment in Barbados under CARICOM agreements.

Is the residency application process in Barbados efficient?

Yes, the process is streamlined and efficient, involving steps like investment selection, due diligence, and documentation submission. Experienced advisors can assist with compliance to ensure approval.

Are there risks associated with investing in Barbados for residency?

Potential risks include real estate depreciation and market fluctuations. Applicants can mitigate these risks through thorough research and investment diversification.

Why is partnering with an advisor recommended for residency applications?

Experienced advisors help navigate Barbados residency laws, ensure compliance, and provide insights into suitable investments, increasing the likelihood of approval and reducing rejection risks.