Medical tourism investment is rapidly transforming the global healthcare landscape, offering lucrative opportunities for investors and governments alike. As more patients seek affordable, high-quality medical care abroad, the demand for advanced facilities and specialized services continues to soar. This growing trend is reshaping economies while bridging gaps in healthcare accessibility worldwide.

You’re stepping into a sector fueled by innovation, competitive pricing, and a desire for better patient experiences. From state-of-the-art hospitals to wellness retreats, the possibilities for creating value are endless. Countries with strong infrastructure and skilled professionals are emerging as key players, driving both economic growth and international recognition.

Understanding the dynamics of medical tourism is crucial for making informed decisions. By aligning with market trends and patient needs, you can unlock significant returns while contributing to global healthcare progress. It’s a unique opportunity to merge profit with purpose in a thriving industry.

Caribbean Real Estate: Investment in the Medical Tourism Sector

Introduction to Medical Tourism

Medical tourism is transforming global healthcare investing, and the Caribbean has become a prominent destination in this dynamic sector. Offering quality healthcare facilities alongside tropical environments, the region attracts both patients and investors seeking innovative opportunities.

Investment potential in the Caribbean is driven by an increasing number of medical travelers who combine treatment with vacationing. This growth aligns with market trends favoring regions that leverage real estate development to enhance healthcare infrastructure.

Growing Demand for Healthcare Services in the Caribbean

The demand for healthcare services in the Caribbean is rising due to cost-effective options and access to skilled professionals. Countries like the Cayman Islands have gained recognition for advanced medical care, such as specialized treatments and state-of-the-art healthcare facilities.

Market trends predict continued growth in the sector as governments and private investors prioritize expanding medical capacities. Healthcare services in the region also cater to aging populations globally, further solidifying its appeal.

Role of Real Estate in Supporting Medical Tourism

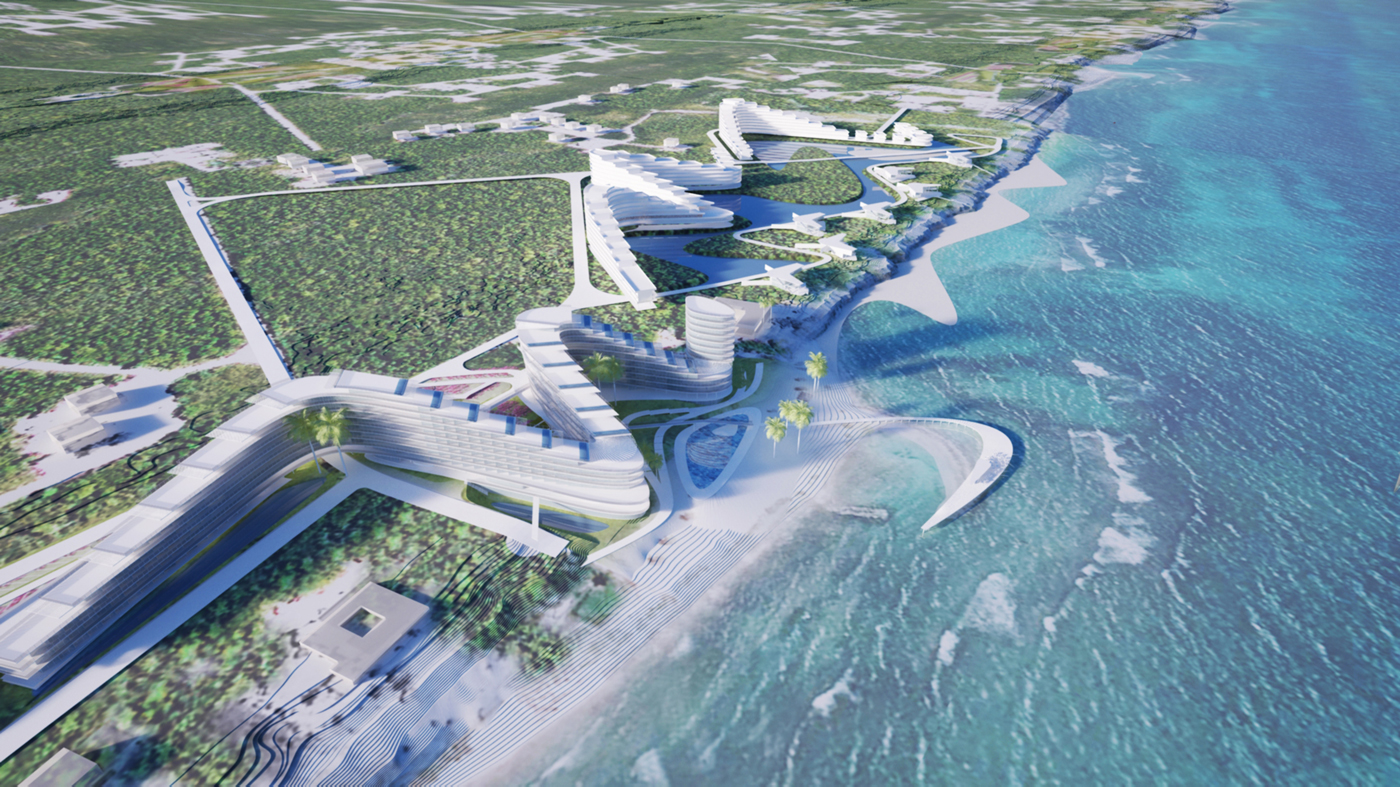

Real estate development plays a pivotal role in advancing medical tourism in the Caribbean. Modern facilities, including hospitals, recovery centers, and wellness resorts, elevate the overall patient experience while boosting investor returns.

The Cayman Islands exemplify this potential, with purpose-built infrastructure catering to medical travelers. Investments in real estate are meeting rising demand and enhancing the region’s reputation as a healthcare hub.

Case Study: Cayman Islands

The Cayman Islands have become a prominent hub for medical tourism, blending advanced healthcare facilities with strategic investment opportunities. Its reputation for providing top-tier medical care attracts patients and investors alike, positioning it as a leading destination in the Caribbean’s expanding healthcare sector.

Success of Health City Cayman Islands

Health City Cayman Islands exemplifies the region’s success in medical tourism. This state-of-the-art facility provides specialized services, including cardiology, oncology, and orthopedics, attracting international patients seeking quality treatment at competitive costs. Its high-standard medical infrastructure meets global healthcare benchmarks, combining affordability with expertise.

Since its establishment, Health City has also contributed to the local economy. By drawing patients and fostering real estate development around its operations, it showcases the economic ripple effects of investing in world-class healthcare facilities. The hospital’s focus on patient-centered care and international accreditations highlights the Cayman Islands’ potential as a model for medical tourism investment.

Key Lessons for Investors

Investing in healthcare facilities in the Cayman Islands offers substantial returns due to growing demand for advanced Cayman medical treatment. The region’s favorable regulatory environment, coupled with its reputation for excellence, supports long-term investor confidence. Aligning investments with market trends, such as aging populations and demand for specialized care, further enhances profitability.

Real estate development near healthcare hubs like Health City creates additional income opportunities. Establishing upscale accommodations or wellness centers for patients and families can maximize investment potential. By prioritizing infrastructure and targeting key patient demographics, you can tap into the Cayman Islands’ expanding medical tourism market with confidence and foresight.

Investment Opportunities

Investment opportunities in the Caribbean medical tourism sector continue to expand, fueled by demand for high-quality healthcare facilities and innovative services. Countries like the Cayman Islands exemplify the investment potential within this niche, showcasing how aligning with market trends benefits both investors and local economies.

Developing Hospitals and Wellness Centers

Establishing hospitals and wellness centers within the Caribbean creates opportunities to meet the rising international demand for affordable, high-standard medical services. Specialized facilities offering treatments like cardiology, oncology, and orthopedics tap into a growing market segment. For example, Health City Cayman Islands exemplifies the success of such ventures, attracting global patients with state-of-the-art medical infrastructure.

Investing in medical facilities ensures long-term returns, as high-quality healthcare remains a consistently sought-after service. Incorporating holistic wellness services such as rehabilitation and preventive care maximizes market reach. Aligning development projects with local regulations and fostering partnerships with established healthcare providers enhances the viability of these investments.

Hospitality and Healthcare Integration

The integration of hospitality services with healthcare infrastructure creates a seamless patient experience while opening new revenue streams. Premium accommodations near healthcare hubs such as Health City Cayman Islands cater to medical tourists seeking convenience and comfort during recovery. Incorporating wellness-focused real estate developments, like luxury apartments and resort-style lodging, strengthens the sector’s appeal.

Investment in this integration also capitalizes on market trends favoring enhanced patient experiences. Upscale recovery environments, personalized care packages, and proximity to healthcare facilities distinguish your offerings from competitors. This synergy between hospitality and healthcare not only boosts profitability but also enhances regional reputation, driving broader medical tourism activity.

Market Trends and Benefits

Medical tourism investment demonstrates significant growth, creating opportunities for investors to capitalize on market trends and the increasing demand for advanced healthcare facilities. Leveraging regions like the Caribbean, particularly the Cayman Islands, aligns investments with evolving patient needs and economic benefits.

Increasing Demand for Specialized Services

Patients increasingly seek specialized healthcare services, driven by affordability and quality care options abroad. Areas like cardiology, oncology, and orthopedics experience higher demand, making investments in such specialties lucrative. In the Cayman Islands, Health City exemplifies this trend by offering world-class services that attract patients globally.

Investing in facilities that provide advanced diagnostics or niche care fulfills a critical market gap. With aging populations and chronic disease prevalence rising, creating centers focusing on wellness and rehabilitation further enhances investment potential. Offering personalized services, such as post-operative care in tropical destinations, broadens the appeal to medical tourists pursuing holistic treatment solutions.

Boosting Local Economies and Infrastructure

Medical tourism fosters economic growth by driving real estate development and improving local infrastructure. Successful healthcare hubs, such as Health City Cayman Islands, spark secondary industries like luxury accommodations, dining, and transportation, boosting the local economy by generating employment and encouraging urban development.

Hospital investments paired with wellness centers increase regional competitiveness. The Cayman Islands leverage their regulatory environment and quality healthcare facilities to attract foreign direct investment. This creates a cycle where advanced medical services benefit from modernized infrastructure, enhancing patient experiences while unlocking long-term revenue opportunities for stakeholders.

Why Medical Tourism is a Strategic Investment in the Caribbean

Caribbean medical tourism represents a high-growth investment market, driven by its competitive healthcare facilities and services. With advanced infrastructure and skilled medical professionals, the region attracts global patients seeking affordable, high-quality care. The area’s tropical appeal and proximity to North and South America further boost its competitiveness as an investment destination in this sector.

Healthcare Facilities as Pillars for Investment

Healthcare facilities in the Caribbean combine cutting-edge technology with cost-effective treatment options. Facilities like Health City in the Cayman Islands set benchmarks for excellence, offering specialized services in cardiology, oncology, and orthopedics. Investments in such hospitals provide access to a solid foundation of high-standard infrastructure and care, meeting the demand for international medical tourism.

Investment Potential in a Growing Market

The Caribbean’s medical tourism growth opens significant investment potential. Rising healthcare demands, favorable regulations, and untapped markets make the region attractive for investors worldwide. Expansion of medical hubs like Health City continues to demonstrate the financial viability of healthcare investments, with their integration of competitive pricing and specialized treatment.

Real Estate Development and Secondary Revenue

Real estate development complements medical tourism investments in the Caribbean. Hospitals and wellness hubs generate secondary revenue streams through adjacent lodging and recovery-focused accommodations. In the Cayman Islands, luxury real estate near major healthcare hubs provides convenience for international patients, creating opportunities to align properties with growing market trends.

Market Trends Driving Sustained Growth

The region’s market trends include increasing demand for specialized services like cancer treatments and orthopedic procedures. Cayman medical treatment facilities are uniquely positioned to address these needs, offering advanced care while keeping prices competitive. Investors aligning with these trends can capitalize on the growing influx of medical tourists, who prioritize quality over cost alone.

Strategically placed healthcare and real estate projects in the Caribbean connect high patient volumes with long-term profitability, setting this region apart in the global medical tourism landscape.

Conclusion

Investing in medical tourism offers you a unique opportunity to tap into a rapidly expanding global market. The Caribbean, with its advanced healthcare facilities and growing reputation, stands out as a prime destination for profitable ventures. By aligning your investments with patient needs and market trends, you can unlock substantial returns while contributing to the region’s economic growth.

Whether it’s developing state-of-the-art hospitals or integrating wellness and hospitality services, the potential for success in this sector is immense. With its favorable regulatory environment and increasing demand for specialized care, the Caribbean medical tourism market positions you to thrive in a competitive, high-growth industry.