Introduction

The United Kingdom’s non-domiciled (non-dom) tax regime has long been a cornerstone of its appeal to globally mobile families. For decades, it allowed international residents to legally shield foreign income and offshore assets from UK taxation—provided those funds were not remitted into the country. This framework helped transform London into a global hub for wealth, investment, and international business.

But in 2025, that long-standing privilege is coming to an end.

The UK government has announced sweeping reforms that will abolish the remittance basis of taxation and replace it with a worldwide income system. This change will subject all UK tax residents—regardless of domicile—to tax on their global earnings and gains. Offshore trusts, once considered safe havens under the non-dom structure, will face increased scrutiny and reduced protections.

For high-net-worth individuals, entrepreneurs, and international families, this signals more than a policy change. It’s a fundamental redefinition of what it means to live—and build wealth—in the UK. Thousands are now actively exploring ways to exit the system entirely.

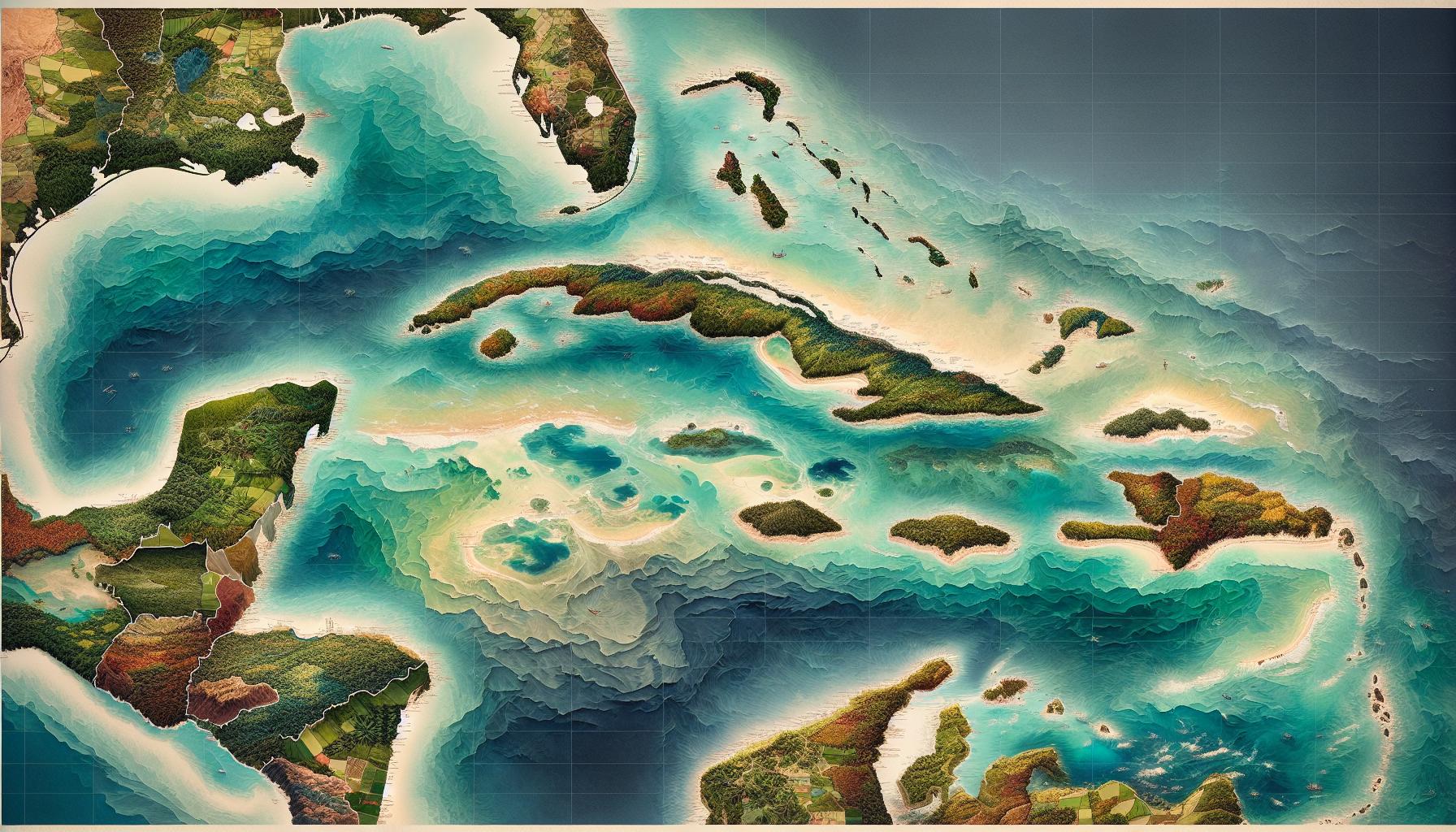

While jurisdictions like the United States, Switzerland, and the UAE may come to mind first, a growing number of families are turning to a more strategic, and in many ways more accessible, solution: the Caribbean.

With its combination of tax neutrality, English common law systems, low-cost citizenship and residency programs, and a high standard of living, the Caribbean is fast becoming a preferred destination for former UK non-doms seeking a legal, long-term base for their personal and financial lives.

This article explores what the UK reforms mean in practice, why the Caribbean is attracting sophisticated families, and how to structure an effective and compliant exit—whether through second citizenship, real estate investment, or global trust planning.

Understanding the Shift: What’s Happening to the UK Non Dom System?

The End of the Remittance Basis

This marks a fundamental shift in how the UK treats globally mobile wealth. No longer will claiming foreign domicile protect a resident from UK taxes. The new regime replaces the old with a simplified—but much broader—system of taxation, where residency alone triggers global tax exposure.

HMRC Scrutiny and the Global Tax Shift

With this shift, HMRC will also intensify scrutiny of taxpayer behavior. Families seeking to preserve their structures will need to demonstrate clear tax non-residency, proper planning, and legitimate foreign ties. As a result, the UK non-dom tax exodus of millionaires is no longer a prediction—it is already underway.

Why the Caribbean Is Becoming the Go-To Exit Strategy

The end of non-dom status in the UK has sent many high-net-worth families searching for a new jurisdiction to base their lives and their wealth. And while jurisdictions like Switzerland, Dubai, or Malta may seem like obvious choices, the Caribbean is increasingly proving to be the most practical and effective solution—especially for UK nationals.

These small, sovereign nations offer much more than just sunshine. They offer legally grounded tax neutrality, citizenship or residency pathways, and common law systems built to accommodate international investors.

Five Reasons the Caribbean Is a Strategic Choice

Favorable Tax Regimes

Most Caribbean nations impose no personal income tax, no capital gains tax, no inheritance tax, and no wealth tax. That makes them ideal jurisdictions for preserving capital, managing passive income, and building multigenerational wealth.

British Common Law Foundations

For UK families, the legal systems in the Caribbean feel familiar and secure. These countries are former British colonies, governed by common law, and operate in English. The cultural and legal alignment makes the transition easier.

Investment Migration and Residency Options

Several Caribbean nations offer fast-track citizenship by investment (CBI) or residency by investment programs. Citizenship can be obtained in as little as 3–6 months, often with a real estate investment or a government donation starting at $100,000 USD.

Real Estate-Backed Entry Points

Unlike jurisdictions that require abstract economic contributions, the Caribbean allows families to obtain citizenship or residency through tangible investments in approved real estate—properties that can be enjoyed or rented while preserving capital.

Mobility, Privacy, and Discretion

CBI countries like St. Kitts & Nevis, Antigua & Barbuda, and Dominica offer visa-free travel to over 140 countries. These jurisdictions maintain privacy while adhering to global transparency standards and offer high degrees of discretion.

Caribbean Jurisdictions Attracting UK Families

The Bahamas: Zero-Tax Living with Financial Sophistication

The Bahamas imposes no personal income tax, no capital gains tax, and no inheritance tax. While it doesn’t offer citizenship by investment, it does allow permanent residency for those investing $750,000 or more in real estate. Its proximity to the U.S., developed financial sector, and exclusive gated communities make it a favorite for ultra-high-net-worth families seeking tax efficiency without sacrificing lifestyle.

Barbados: Tax Efficiency with Onshore Respectability

Barbados combines low corporate tax (1–5.5%) with strong treaty access and legal infrastructure. It doesn’t offer a citizenship program, but permanent residency is available to property owners. Its high quality of life, international schools, and professional services sector make it especially attractive for those seeking real substance alongside fiscal efficiency.

Antigua & Barbuda: Family-Friendly CBI and Lifestyle Access

Antigua’s citizenship program is one of the most affordable in the world, especially for large families. A donation of $100,000 or a $200,000 real estate purchase qualifies a family of four. The country has no personal income, inheritance, or capital gains tax. It also offers a relaxed lifestyle, English-speaking education, and direct flights to London, New York, and Toronto.

St. Kitts & Nevis: The Gold Standard in Caribbean Citizenship

St. Kitts & Nevis is the birthplace of the citizenship by investment model. It offers one of the fastest, most established programs, with zero personal income, capital gains, or estate tax. Investors can qualify through a $250,000 donation or a $400,000 real estate investment. The Nevis trust system is world-renowned for wealth protection and is used by global family offices and estate planners.

Cayman Islands: Premier Zero-Tax Financial Hub

Cayman is one of the most respected offshore financial centers globally. It offers no direct taxes and unparalleled access to professional services, banks, and legal support. While it doesn’t offer citizenship or CBI, long-term residency is available with a $2.4 million USD property investment. It appeals to investment firms, digital entrepreneurs, and UHNWIs seeking credibility and discretion.

Anguilla: Low-Profile, High-Privacy Residency Option

Anguilla offers a Residency by Investment program starting at just $150,000. It is lesser-known than its neighbors, but attractive to families who value simplicity, safety, and privacy. It is also a British Overseas Territory, which may provide long-term optionality.

St. Lucia: Still Viable, But Losing Ground

St. Lucia still offers a CBI program with options starting at $100,000. But recent increases in pricing and a limited number of quality real estate projects have made it less attractive for wealthier applicants. The country maintains zero inheritance and capital gains taxes, but its competitiveness has diminished compared to more established neighbors.

Structuring the Exit: How to Leave the UK Non-Dom System the Right Way

Establishing Tax Residency Abroad

To successfully leave the UK tax net, families must not only move physically—they must also establish legal, factual, and enduring tax residency abroad. Most jurisdictions require at least 183 days of presence per year. Some offer tax residency certificates or long-term residence permits to solidify one’s new status.

Restructuring Offshore Trusts and Holding Vehicles

UK non-doms have historically used offshore trusts to hold global wealth. But under the new rules, these trusts may become exposed. Families should consider moving trustees to neutral jurisdictions (such as Nevis or Jersey), changing governing law, or redomiciling corporate holding entities. Caribbean trust structures can be used to preserve long-term wealth while staying out of HMRC’s reach.

Managing UK Asset Exposure and Income Flows

Retaining UK assets may continue to attract UK tax. Rental income, dividends, or capital gains from UK-based companies or property will be taxed by HMRC regardless of residency. Families may choose to divest from UK assets, shift income-generating activities abroad, or utilize treaty-based planning where possible. Careful structuring of management fees, royalties, and holding companies is essential.

Building a Coordinated Global Strategy

Exiting the UK requires more than just legal paperwork—it requires coordination across immigration, banking, investment, legal, and tax domains. Families must think through where they live, how they report income, where their trusts are located, and where their assets generate revenue. Advisors in multiple jurisdictions should be engaged to map a fully compliant, long-term plan.

Other Popular Non-Dom Alternatives Outside the Caribbean

While the Caribbean offers some of the most accessible and effective options, other non-dom alternatives continue to attract UK families—especially those looking for EU access, Asian business infrastructure, or Middle Eastern investment opportunities.

United Arab Emirates (UAE): Zero Tax and Global Prestige

The UAE imposes no personal income tax or capital gains tax. With long-term Golden Visas available to investors, property owners, and entrepreneurs, it remains a top destination for HNWIs from the UK and around the world. Dubai in particular has become a hub for crypto investors, private equity professionals, and family offices.

Malta: EU Residency with Remittance-Based Taxation

Malta is one of the last EU countries to offer a remittance basis tax regime. Residents are only taxed on foreign income if it is remitted to Malta. This allows global families to maintain EU presence while legally avoiding tax on most foreign assets. Malta also offers residency and citizenship routes under strict due diligence.

Italy: €100,000 Flat Tax for Foreign Income

Italy’s flat tax regime allows qualifying new residents to pay a flat €100,000 annually on all foreign income. Additional family members can be added for €25,000 each. The regime lasts up to 15 years and offers EU residency along with luxury living in places like Milan, Florence, or Lake Como.

Hong Kong: Territorial Regime for Asia-Based Portfolios

Hong Kong taxes only income sourced within the jurisdiction. Offshore profits, foreign dividends, and capital gains are typically not taxed. For families with Asian investments or business operations, Hong Kong remains a leading low-tax jurisdiction with strong legal and banking systems.

Final Thoughts: From Non-Dom to Global Citizen

The end of the UK non-dom regime represents a turning point—not just for tax policy, but for how global families organize their lives and protect their wealth. For many, it’s a moment of frustration. But for others, it is a strategic opportunity to reassess their jurisdictional footprint and align their structures with long-term goals.

The Caribbean offers more than tax advantages. It offers sovereignty, legal clarity, mobility, and a better quality of life. These are not shortcuts or loopholes. They are sovereign choices—available to those with foresight and the right advisors.

If you are exploring your options as a UK non-dom or advising clients in that position, I can help. My team specializes in cross-border real estate investment, citizenship by investment, offshore trust planning, and tax residency relocation throughout the Caribbean and beyond.