Introduction

Global business is changing fast—and so are the strategies needed to stay competitive, tax-efficient, and secure. For investors, founders, and international consultants, the ability to operate beyond the borders of your home country is no longer just an advantage—it’s a necessity. One of the most effective tools to achieve that is an offshore company.

Registering an offshore company in the Caribbean offers more than just a low-tax structure. It gives you access to legally protected corporate environments, simplified international operations, and a level of privacy and flexibility that onshore jurisdictions increasingly lack.

Whether you’re setting up a holding company, protecting your intellectual property, or optimizing global trade, the Caribbean’s offshore jurisdictions—like the British Virgin Islands, Cayman Islands, Nevis, and St. Lucia—are built for cross-border business. With fast incorporation, world-class legal frameworks, and minimal reporting requirements, these destinations offer proven tools for global scalability and long-term protection.

In this guide, we’ll walk through everything you need to know about forming an offshore company in the Caribbean—from choosing the right jurisdiction and structure to filing, banking, compliance, and beyond. If you’re serious about protecting your assets and expanding your global footprint, this is where you start.

What Is an Offshore Company?

An offshore company is a legal entity incorporated outside the country where its owners reside. These companies are typically formed in low-tax or no-tax jurisdictions and are used for purposes like global trade, IP holding, asset protection, and financial structuring.

Offshore companies are fully legal and widely used by multinational firms, investment managers, solo entrepreneurs, and digital nomads. When structured correctly, they offer legitimate advantages in areas like tax efficiency, privacy, and international business flexibility.

In the Caribbean, most offshore companies fall under two categories: International Business Companies (IBCs) and Limited Liability Companies (LLCs). They’re often exempt from local taxation if income is sourced from outside the jurisdiction.

Benefits of Offshore Companies in the Caribbean

-

Tax Efficiency: Most jurisdictions offer zero corporate tax on foreign-sourced income.

-

Asset Protection: Caribbean laws are built to shield assets from lawsuits, creditors, and political risk.

-

Privacy: Directors and shareholders are not publicly listed in many Caribbean registries.

-

Fast Incorporation: Setup can often be completed within 1–3 business days.

-

Global Reach: Jurisdictions like BVI and Cayman enjoy excellent reputations with banks, funds, and law firms globally.

Choosing the Right Jurisdiction

Choosing where to incorporate offshore isn’t just about picking a tax haven. It’s about aligning the jurisdiction’s legal framework, banking relationships, reputation, and regulatory environment with your business goals—whether that’s asset protection, fund structuring, holding global IP, or simply launching fast with maximum privacy.

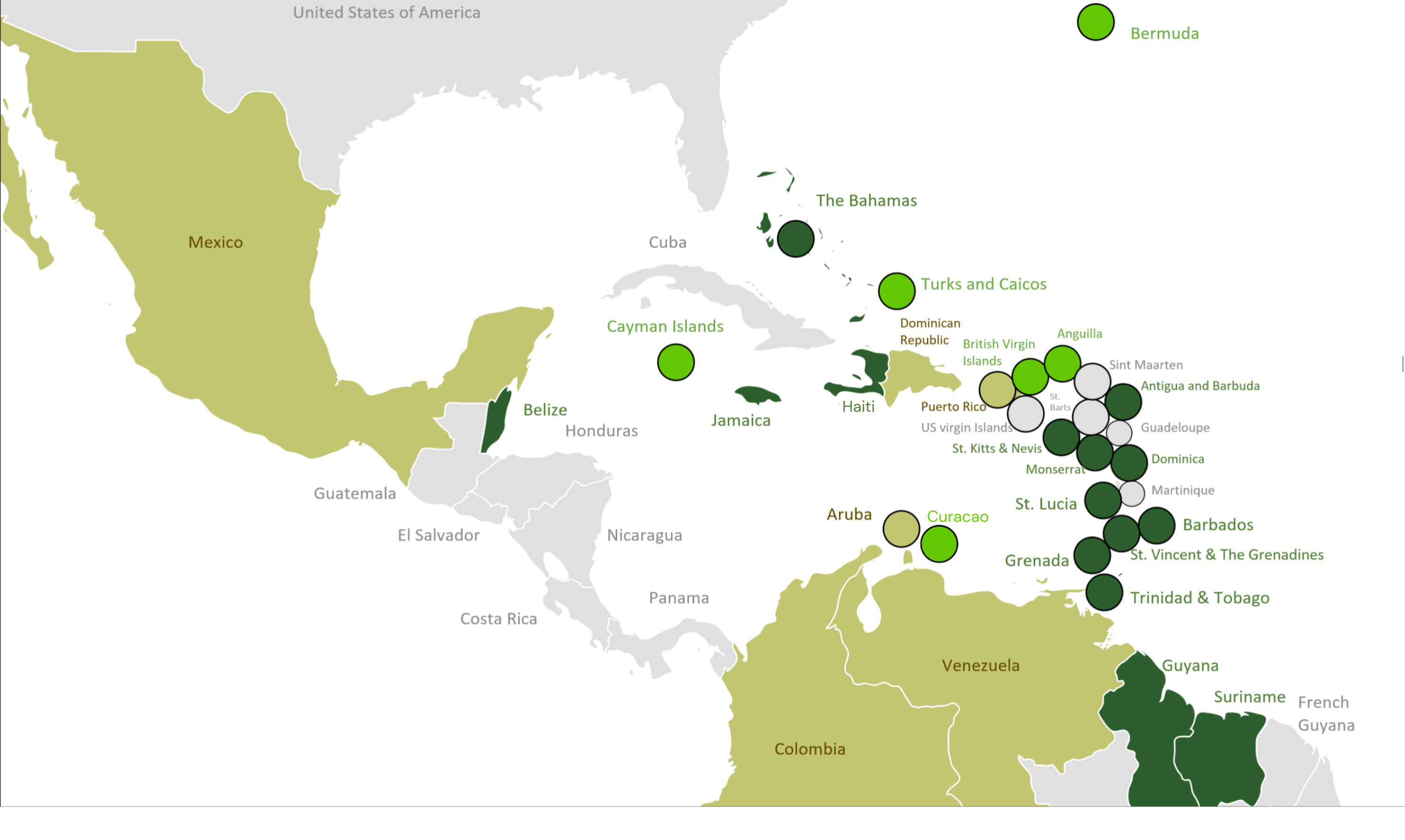

Each Caribbean jurisdiction offers distinct advantages. Some are fast and discreet. Others are treaty-rich and compliant. Below is a detailed overview of the most relevant offshore company jurisdictions in the Caribbean, what makes each one unique, and who they’re best suited for.

British Virgin Islands (BVI)

The British Virgin Islands remain the most popular offshore company jurisdiction in the world—and for good reason. The BVI has registered hundreds of thousands of companies due to its well-established IBC framework, zero tax on foreign income, and global credibility.

Companies here are quick to form (1–3 business days), inexpensive to maintain, and widely accepted by international banks and investors. The BVI Financial Services Commission maintains strong oversight, which helps the jurisdiction remain clean and compliant, while still protecting privacy—beneficial owner disclosures are filed privately, not publicly.

BVI is a top pick for holding companies, investment vehicles, and joint venture structures. Its flexibility makes it ideal for founders, funds, and international partnerships needing something lightweight, bankable, and proven.

Best for: Holding companies, startups, investment structures, trust integration.

Cayman Islands

The Cayman Islands is the gold standard for high-end offshore structuring. There are no direct taxes—no corporate income tax, no capital gains tax, no withholding tax—and its legal and regulatory systems are among the most respected in the world.

Cayman is the jurisdiction of choice for institutional-grade entities: hedge funds, venture capital funds, family offices, and investment platforms. The Cayman Exempted Company structure is robust, flexible, and globally recognized. With hundreds of top-tier service providers on the ground, Cayman offers white-glove support for high-value structures.

While setup and maintenance costs are higher than BVI or Nevis, the value lies in Cayman’s brand. If you’re seeking regulatory clarity, strong banking relationships, or investor trust, Cayman delivers.

Best for: Funds, multinational holding companies, institutional investors, UHNW families.

Nevis

Nevis is widely considered the best offshore jurisdiction in the world for asset protection. Its LLC laws are specifically designed to shield companies from lawsuits, creditor claims, and foreign court judgments. It’s the go-to destination for estate planners, real estate investors, and those needing bulletproof wealth structures.

A Nevis LLC does not require the disclosure of ownership or management in public registries. Even if a foreign judgment is obtained, creditors must post a bond (often $100,000+) just to pursue a claim locally—making litigation extremely difficult and costly.

Nevis companies are easy to form, private by default, and often paired with Nevis trusts for even stronger legal protection. If you want to create a protective firewall around wealth, Nevis is unmatched.

Best for: Asset protection, trusts, holding entities, litigation defense.

St. Lucia

St. Lucia offers an excellent balance of efficiency, affordability, and legal protection. It supports both IBCs and LLCs, provides zero tax on foreign income, and incorporates quickly—usually within 2–3 business days. Its banking infrastructure is growing steadily, and local law firms offer reliable ongoing support.

St. Lucia is particularly popular with digital entrepreneurs, consultants, and lean online businesses. You can run a lightweight structure while maintaining control, privacy, and compliance with global standards. With minimal local reporting and affordable maintenance costs, it’s a smart option for those who want offshore capabilities without institutional complexity.

Best for: Digital entrepreneurs, small service firms, IP holding, lean structures.

Anguilla

Anguilla is one of the simplest and most cost-effective offshore jurisdictions in the Caribbean. With zero corporate tax on foreign income, no public registry of owners, and fast incorporation (often same day), it offers clean and efficient company formation without the need for overcomplicated administration.

Anguilla’s IBC structure is ideal for crypto ventures, remote-first businesses, and minimalist holding vehicles. It’s also increasingly used by clients seeking fast formation for time-sensitive launches. While it doesn’t carry the same global prestige as BVI or Cayman, it offers privacy, simplicity, and speed at a very competitive price point.

Best for: Crypto projects, fast-launch companies, small asset holdings, digital firms.

Barbados

Barbados is not a traditional “offshore” haven, but it’s one of the most advanced low-tax jurisdictions in the Caribbean. With corporate tax rates starting as low as 1%, and over 40 tax treaties—including with Canada, the UK, and many EU countries—it provides compliant international tax planning options for mid-to-large firms.

Companies formed in Barbados are treated as tax-resident and must file accounts, which offers credibility with banks and global partners. This is especially valuable for businesses needing legal substance, regional headquarters, or treaty access without the stigma of a zero-tax structure.

Best for: Treaty access, tax-compliant planning, Canadian and UK business owners, substance-based operations.

St. Vincent and the Grenadines

St. Vincent offers simple, low-cost company formation with zero tax on offshore income and strong privacy. Incorporation is fast—usually 1–2 business days—and maintenance is minimal. It’s a niche jurisdiction best suited for entrepreneurs launching small-scale ventures that don’t need global prestige or deep banking relationships.

Its lack of a strong legal brand can be a drawback when dealing with institutional partners, but for cost-sensitive founders or basic corporate structuring, it gets the job done.

Best for: Budget-friendly setups, early-stage businesses, regional ventures.

Antigua & Barbuda

Antigua & Barbuda is an offshore-friendly jurisdiction with growing infrastructure and strong legislation for international companies. Offshore entities benefit from zero corporate tax on foreign income and flexible company structures. Antigua is also a CBI (Citizenship by Investment) destination, allowing some investors to pair their business interests with second citizenship.

While it’s not yet a dominant offshore hub, its legal framework is evolving, and it’s becoming increasingly viable for dual-purpose structures—especially for founders or families who want lifestyle, business, and immigration options all in one country.

Best for: Hybrid citizenship + offshore setups, Caribbean regional planning, mid-sized holding structures.

Step-by-Step: How to Register an Offshore Company in the Caribbean

1. Choose Your Jurisdiction

Match your goals (privacy, asset protection, tax efficiency) with a jurisdiction that fits. For example:

-

Nevis = asset protection

-

BVI = simple, bankable holding company

-

Cayman = fund or institutional-grade structure

2. Reserve a Company Name

Check the name against the registrar to ensure availability. Avoid restricted terms unless licensed (e.g., “Bank,” “Trust”).

3. Prepare Documentation

You’ll need:

-

Certified passport copy and proof of address

-

Company structure and business purpose

-

Articles of Incorporation or M&A

-

Names and roles of directors/shareholders

4. Appoint a Registered Agent

All Caribbean jurisdictions require you to use a local agent or licensed incorporation provider. They’ll handle filings and act as your legal point of contact.

5. File Incorporation Documents

Submit your paperwork to the registrar. Most approvals are processed within 1–3 business days.

6. Open a Corporate Bank Account

This can be done locally or internationally. You’ll need to submit KYC documents, ownership structure, and potentially a business plan or financial forecast.

7. Pay Government Fees and Get Your Certificate

Once registered, you’ll receive your certificate of incorporation and company number. Pay any license fees or annual maintenance costs.

Post-Registration Requirements

Understanding post-registration requirements ensures your offshore company setup complies with regulatory standards and operates smoothly within selected offshore jurisdictions.

Compliance and Reporting Obligations

Adherence to local regulations is vital for maintaining the status of your offshore company. Most offshore jurisdictions, such as the British Virgin Islands and the Cayman Islands, require annual compliance measures. For example, you may need to file reports, including financial summaries or declarations of solvency.

Some jurisdictions may mandate annual licence fees or renewal fees to maintain business registration. Failure to meet these obligations can result in penalties or even company suspension. Anti-money laundering (AML) and counter-terrorism financing (CTF) compliance are critical, particularly in Caribbean offshore entities. Conduct regular audits of operations to ensure compliance with these standards.

When appointing a registered agent or management service provider, confirm they are licensed and knowledgeable about the jurisdiction’s reporting framework. Their expertise can streamline submissions and provide additional assurance of legal conformity.

Maintaining Corporate Records

Keeping detailed records is a statutory obligation for offshore company owners. Maintain a register of directors, shareholders, and any significant control parties as required by local laws. Some jurisdictions also expect records of meetings, resolutions, and changes in company structure to be documented and updated.

Store these records within the registered office or an approved location, as offshore jurisdictions typically require access for authorities upon request. Standard documents, such as the Memorandum of Association and Articles of Association, must remain up to date. Ensure amendments to corporate documents or changes in directorship are promptly filed.

Digital copies of key records can offer additional security while aligning with modern record-keeping standards. Collaborate with authorised service providers to manage these records efficiently and ensure compliance across all operational years.

Leveraging Offshore Companies for Tax Planning and Asset Protection

Strategically using offshore companies enhances tax planning opportunities and asset protection. In jurisdictions such as the Bahamas and Nevis, you can benefit from tax-neutral regulations, reducing the overall tax burden on earnings and investments.

Asset protection is a core advantage of an offshore company setup. These entities often provide legal safeguards against claims or unforeseen liabilities, with robust privacy protections in place. For example, the Caribbean offshore jurisdictions uphold beneficial ownership confidentiality laws, shielding personal asset details from public registers.

Work with financial advisors and legal experts to structure operations for optimal tax benefits while avoiding conflict with international tax treaties. Diversify investment portfolios through these entities to secure assets globally under favourable legal frameworks. Offshore service providers can further assist in maximising these advantages by recommending compliant tax strategies.

Other Global Jurisdictions (Outside the Caribbean)

Hong Kong

Hong Kong is one of the most established international business hubs in Asia and remains a powerful jurisdiction for offshore companies involved in trade, e-commerce, and regional holdings. With a territorial tax system, companies only pay tax on income sourced within Hong Kong, making it possible to enjoy zero tax on properly structured offshore profits. The legal system is based on English common law, and the banking infrastructure is world-class. However, increased political integration with mainland China has raised scrutiny, and business owners should be prepared for higher compliance standards—including mandatory audits, a public register of directors, and more detailed KYC protocols. Despite this, Hong Kong remains a strong and respected base for Asian operations with high credibility.

Panama

Panama continues to attract offshore incorporators thanks to its low-cost IBC regime, strategic location, and solid banking options both within and outside the jurisdiction. Companies incorporated in Panama pay no local tax on income earned abroad, and the process is fast and relatively private. It remains especially useful for international logistics firms, Latin American entrepreneurs, and trade-oriented holding companies. That said, since the Panama Papers revelations, global scrutiny has increased. Many international banks and compliance officers now treat Panama-based companies with more caution. If privacy is a priority but you still want to bank globally, Panama may require pairing with a secondary jurisdiction.

UAE (RAK, Dubai, JAFZA)

The United Arab Emirates (UAE) has become a top-tier destination for offshore company formation, especially in the fintech, crypto, and Middle East–Africa corridor. Free zones like Ras Al Khaimah (RAK) and Jebel Ali (JAFZA) offer zero tax, high-end infrastructure, and strong regulatory support. Companies registered here can access top international banks and enjoy visa/residency options as part of the package. The UAE’s reputation has risen significantly in recent years, particularly among digital entrepreneurs and tech founders. While the setup cost is higher than in Caribbean jurisdictions, the access to capital, global connections, and operational prestige make the UAE one of the most compelling offshore bases today.

Malaysia (Labuan)

Labuan is Malaysia’s international financial center, offering a low-tax offshore regime with access to over 70 tax treaties. With a 3% tax on trading income and exemption on non-trading income, Labuan companies are ideal for financial services, fintech, and cross-border consulting businesses operating across Asia-Pacific. Incorporation is straightforward, and light substance requirements make compliance easier than in other treaty-access jurisdictions. Labuan also provides banking access through Malaysia’s robust financial system and offers strong privacy protections for beneficial owners. For those wanting both legitimacy and flexibility in Asia, Labuan is an underrated but effective choice.

Cyprus

Cyprus stands out as an EU jurisdiction with low taxes and deep treaty coverage. It offers a 12.5% corporate tax rate, one of the lowest in Europe, and is especially effective for holding companies, IP structures, and investment vehicles looking to access European markets. Cyprus companies can hold EU assets, issue invoices within the bloc, and participate in cross-border M&A with tax efficiency. The jurisdiction requires some local substance—such as an office, local director, and compliance filings—and beneficial owners are disclosed publicly. Despite that, the level of international credibility, paired with a cooperative regulatory regime, makes Cyprus one of the best “mid-shore” options available.

Estonia

Estonia is the global pioneer of e-Residency and online incorporation, offering 0% tax on retained earnings and a fully digital company formation process. It’s a favorite among tech founders, remote teams, and SaaS businesses due to its operational simplicity and EU legitimacy. Estonian companies pay corporate tax only when profits are distributed, encouraging reinvestment and growth. While transparency is high (director and shareholder data is public), this makes Estonia one of the cleanest and most compliant jurisdictions in Europe. It’s not the best fit for those prioritizing privacy or banking secrecy, but for digital entrepreneurs who value speed and structure, Estonia is extremely attractive.

Georgia

Georgia is quickly gaining ground as a low-regulation, entrepreneur-friendly jurisdiction on the edge of Europe and Asia. Offshore companies here benefit from fast, low-cost incorporation and very few restrictions on foreign ownership or banking. The country offers favorable tax rates, simplified compliance, and visa-free travel for many nationalities. It doesn’t carry the prestige of a Cayman or Cyprus structure, but it’s a practical, agile solution for small teams, solo founders, and location-independent consultants looking for flexibility and autonomy without the overhead.

Conclusion

Offshore companies aren’t just about taxes—they’re about flexibility, control, and future-proofing your wealth and operations.

Whether you’re optimizing income, protecting assets, or expanding internationally, a Caribbean offshore company gives you legal tools to do it right. Jurisdictions like BVI, Nevis, and Cayman are proven, respected, and efficient. And if your needs point elsewhere, options like UAE, Estonia, or Cyprus give you specialized structures suited for modern business.

With the right jurisdiction and a solid provider, you can set up in days and unlock long-term advantages. Offshore isn’t just smart—it’s essential.